State Overview

Texas

National Solar Capacity Ranking: 2nd

Data Current Through: Q4 2024

Texas State Solar Overview

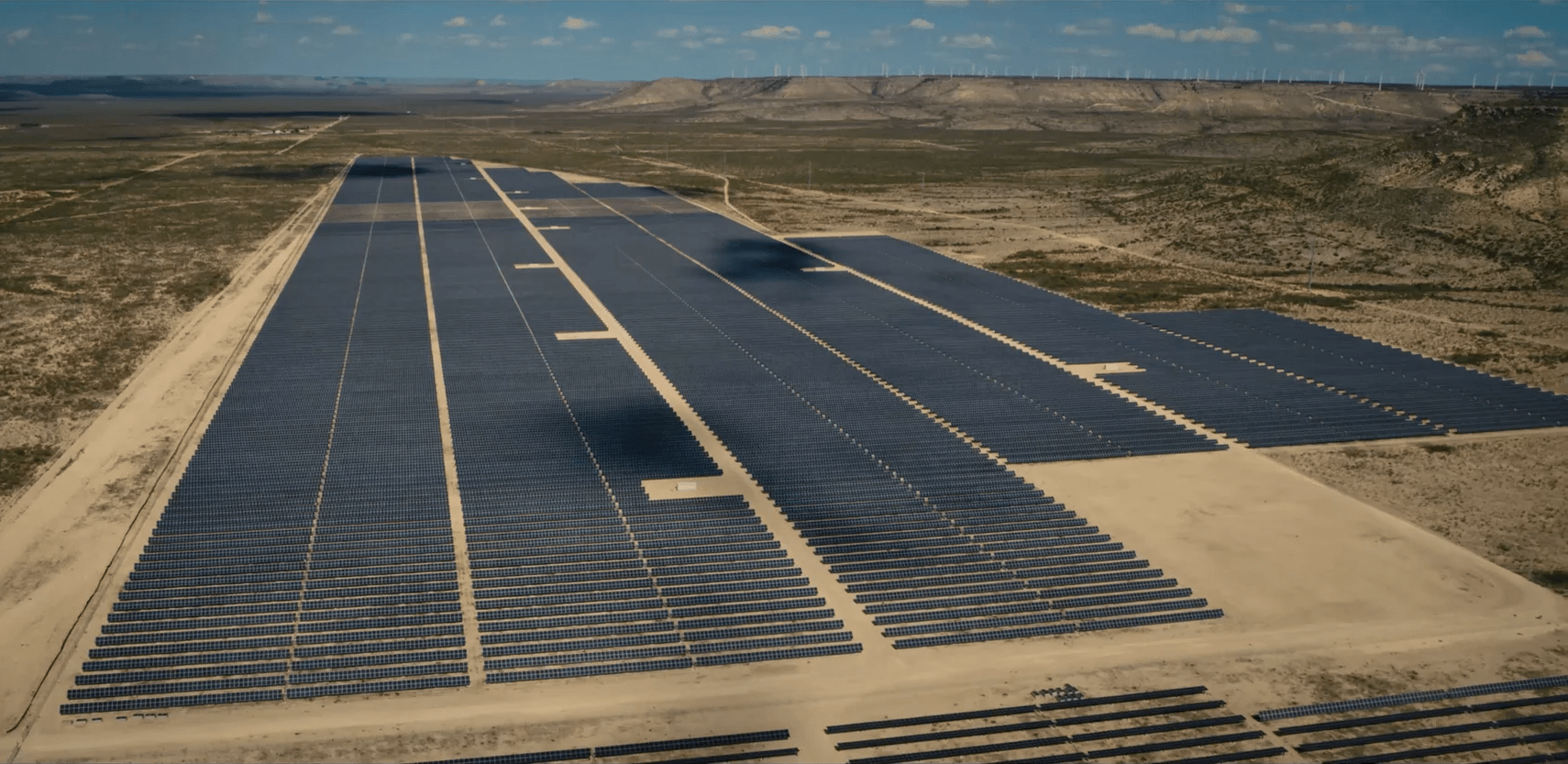

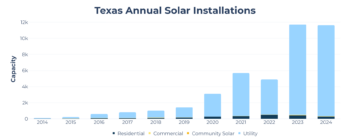

As the Texas economy and population continues to grow, electricity consumption has also increased in the energy capital. New solar and storage will be needed for an “all of the above” strategy to meet the state’s energy demand. Texas led all states in new solar capacity installed in 2023 and 2024 and that trend should continue, barring new state policies that unfairly discriminate against solar and storage. The Texas solar industry employs over 12,000 Texans and is contributing billions in local tax revenue and landowner income, and solar and storage are the biggest sources of new energy on the Texas grid.

SEIA Texas State Policy Priorities

- In the 2025 session, SEIA and other stakeholders will continue to defend against overly-burdensome siting and permitting legislation, such as Senate Bill 819, which seeks to establish a permitting process for renewable energy generation facilities that would not apply to other forms of energy. Among other mandates, it requires operators to obtain a permit from the PUC before construction or operation, mandating setbacks, environmental impact assessments by TPWD, public notices, and hearings.

- SEIA and other stakeholders worked with legislators on consumer protection and education legislation. Senate Bill 1036 (Zaffirini) seeks to strengthen consumer protections and industry standards in the residential solar market while House Bill 1640 (Vandeaver) would provide guidelines and resources for customers seeking a residential solar system.

- SEIA and other stakeholders will be engaged on House Bill 2304, residential permitting reform, which seeks to streamline the local permitting of home back up power systems so that more Texans can enjoy the cost savings and energy independence that solar and storage offers.

- SEIA and other stakeholders will be engaged on utility scale BESS decommissioning policies and safety standards.

- On the regulatory front, SEIA is monitoring and engaging on the exemption process for ERCOT technical standards (Project 57374). These proposed rule changes came out of the discussion regarding NOGRR 245, IBR ride-through requirements, and concern about how those new requirements should be applied to older generation resources.

- SEIA is monitoring the PUC request for comments on the ERCOT Strategic Transmission Expansion Plan (STEP) comparison (Project 55718)

- SEIA is monitoring and has been engaged on the requirement for new ESRs to Provide Advance Grid Support (NOGRR 272 and PGRR 121) and NOGRR 245, the Inverter-Based Resource (IBR) Ride-Through Requirements

Data References:

SEIA/Wood Mackenzie Power & Renewables, Solar Market Insight 2024 Year-in-Review

IREC, National Solar Jobs Census

Energy Information Administration, Electric Power Monthly

SEIA, National Solar Database

Just The Facts

-

Solar Installed (MW):

41,460

-

National Ranking:

2nd (1st in 2024)

-

Enough Solar Installed to Power:

4,966,507 homes

-

Percentage of State's Electricity from Solar:

7.83%

-

Solar Jobs:

12,421

-

Solar Companies in State:

592 (107 Manufacturers, 222 Installers/Developers, 263 Others)

-

Total Solar Investment in State:

$50.1 billion

-

Prices have fallen:

42% over the last 10 years

-

Growth Projection and Ranking:

41,045 MW over the next 5 years (ranks 1st)

-

Number of Installations:

290,194

Texas State Solar Policy Resources

-

DSIRE incentives database – Texas – Search a public clearinghouse for specific solar energy incentives in Texas and across the United States

-

Public Utility Commission – Learn about the governing body that regulates the electricity rates and services of Texas public utilities

-

Texas Solar Panels Overview – Learn about the history of solar policy in Texas, along with up-to-date pricing information on EnergySage

-

Solar Panel Cost in Texas – Learn about the history of solar policy in Texas, along with up-to-date pricing information on EnergySage

-

Solar Rebates & Incentives in Texas – Check out EnergySage’s list of key solar incentives in Texas to see what programs you can benefit from

-

State Energy Office – Find a wide variety of information on state government energy programs, policy, projects, energy-saving strategies and energy-related statistics

-

State Legislature – Track pending legislation affecting solar energy, locate and contact individual legislators, and stay up to date on current legislative issues in Texas

-

U.S. Energy Information Administration – Texas State Profile – Explore official energy statistics, including data on electricity supply and demand, from the U.S. government

Texas Energy Storage Policy and Market Overview

Texas is a colossal leader in the energy storage market and has one of the largest battery storage procurements in the US. The deregulated environment has shaped a wildly competitive environment. Significant actions by ERCOT are easing market barriers, mitigating interconnection risk, and supporting grid resiliency in Texas.

Texas is undoubtedly leading energy storage with about 7 GW of capacity. State policy actions codifying deregulation (SB 1012), and a centralized and streamlined interconnection process are supporting a prosperous market. Several ERCOT task forces are encouraging deployment across sectors. The Aggregate Distributed Energy Resource (ADER) Task Force focuses on regulatory efficiency and aims to establish Virtual Power Plant programs for homeowners. Additionally, the Real-Time Co-optimization plus Batteries Task Force (RTCBTF) is working to coordinate timelines and market readiness for sustained battery storage growth.

ERCOT is leading the storage deployment charge and forecasts Texas reaching over 100,000 MW by 2030. Residential system deployment rates slowed in 2024 due to inflated costs, but active navigation of a VPP program by ERCOT could reignite investments. The fast-track approval process, financial incentives, effective regulatory actors, and the low and abundant cost of land are solidifying Texas as the top energy storage market.

Texas Energy Storage Policy Resources

- Energy Storage Resources Dashboard – Graphical dashboard produced daily by ERCOT tracking average mega-watt values for total discharging, charging, and net output from Energy Storage Resources (ESRs).

- The Texas Energy Fund – Loan and grant funding opportunities financing the construction, maintenance, and modernization of Texas’ energy grid, including BESS. Check out SB 2726 for more information.

- ERCOT Battery Energy Storage – ERCOT energy and battery storage initiatives, guidelines on interconnection, and more.

- Real-Time Co-optimization plus Batteries Task Force (RTCBTF) –Non-voting committee providing policy and market recommendations on wholesale market design and battery rollout.

- Aggregate Distributed Energy Resource (ADER) Pilot Project –Pilot project testing and evaluating aggregated, multi-metered DER site projects.

- Tesla Electric Virtual Power Plant Pilot with ERCOT –Tesla & ERCOT VPP program supporting grid resiliency and providing compensation to owners of home batteries.

- DSIRE Texas Energy Storage Policy Database — Clearinghouse for financial incentives, regulations, and rebates for energy storage and lithium-ion technologies in Texas and across the United States.

- Pacific Northwest National Laboratories Energy Storage Policy Database – Map of Procurement, Regulatory, Demonstration, Incentive, and Interconnection policies in Texas and across the United States.

- Energy Storage Cost in Texas – Up-to-date storage and solar-plus-storage pricing and find installers in Texas on EnergySage.

- Public Utility Commission of Texas – Governing body that regulates the electricity rates and services of Texas public utilities, search for regulatory dockets, programs, and initiatives.

- Texas Legislature – Pending, passed, and historical legislation affecting energy storage and battery systems, locate and contact individual legislators, and stay up to date on current legislative issues in Texas.