49 results for “seia“

Solar Tax Manual

The SEIA Federal Tax Guide for Solar Energy is a regularly updated resource created to guide you and your customers through the federal tax benefits for solar. This detailed guide is a SEIA ...

Solar and Storage Industry Commends Treasury Dept. for Finalizing Tax Credit Transferability Rule

WASHINGTON, D.C — Today the U.S. Department of the Treasury issued new guidance on Section 6418 of the Inflation Reduction Act (IRA) that allows clean energy tax credits to be monetized by directly transferring the credit to a taxpaying entity.

Solar Market Insight Report 2023 Q3

The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight report shows the major trends in the U.S. solar industry. Learn more about the U.S. Solar Market Insight Report. Released September 7, 2023.

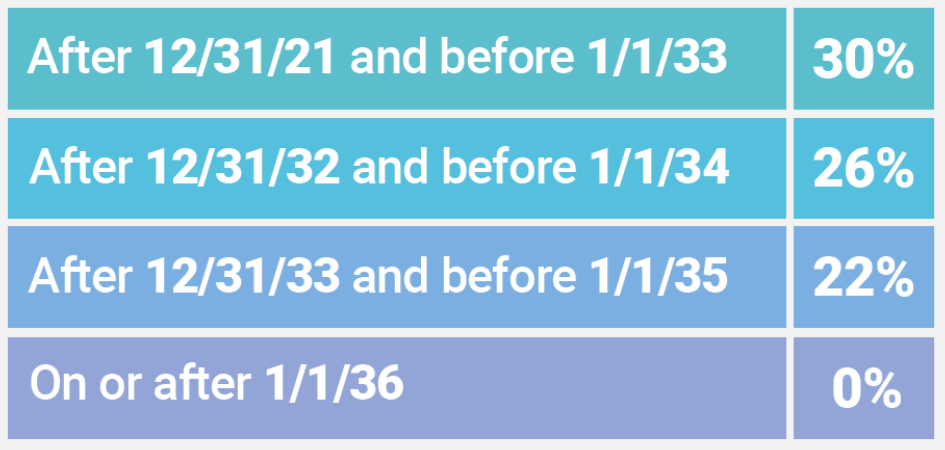

The 25D Solar Tax Credit: What Homeowners Need to Know

The Section 25D residential tax credit may be claimed by individuals who purchase a solar energy system or a standalone energy storage system for their home. SEIA put together this summary to help residential customers understand the basics of Section 25D tax credits.

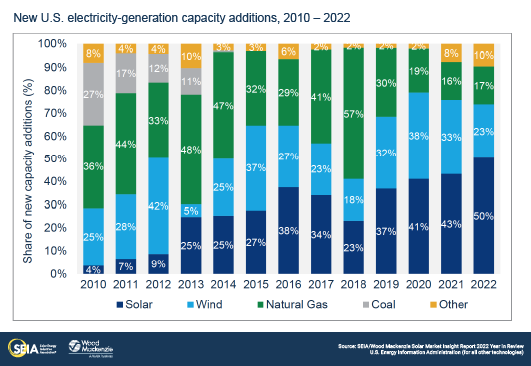

Solar Market Insight Report 2022 Year in Review

The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight report shows the major trends in the U.S. solar industry. Learn more about the U.S. Solar Market Insight Report. Released March ...

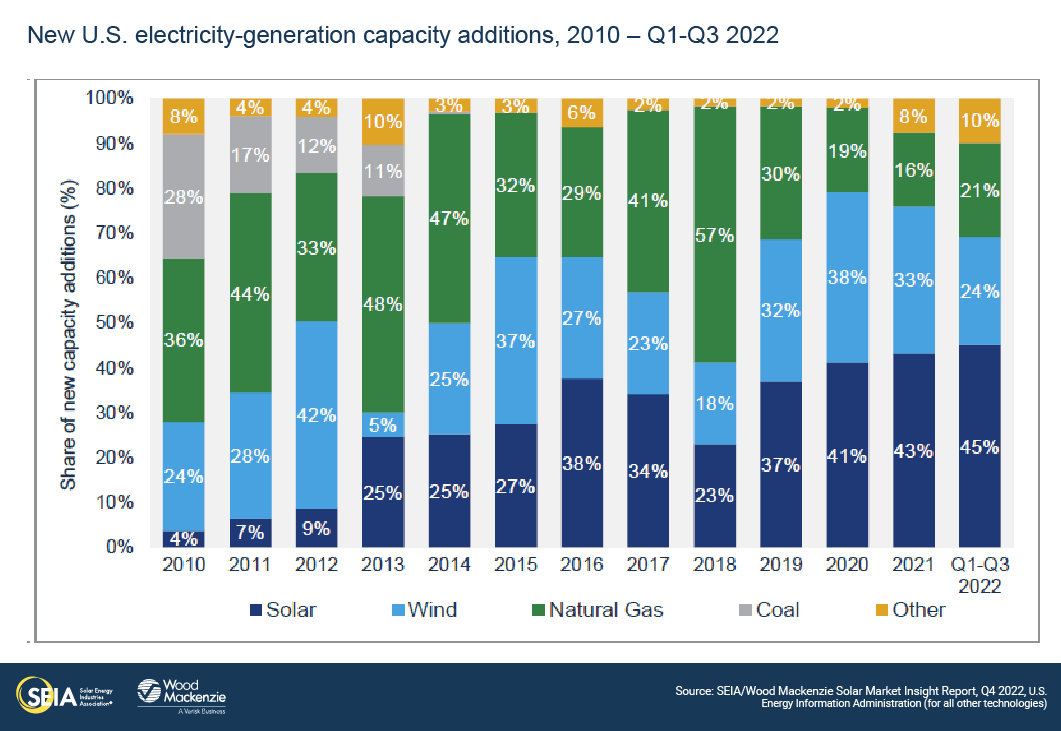

Solar Market Insight Report 2022 Q4

The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight report shows the major trends in the U.S. solar industry. Learn more about the U.S. Solar Market Insight Report. Released December 13, 2022.

Solar Means Business 2022

U.S. businesses and top global brands are making historic investments in solar energy. As of June 2022, Meta leads the nation with the most solar capacity installed, followed closely by Amazon, Apple, Walmart ...

Solar and Storage Industry Makes Recommendations to U.S. Treasury Department on Implementation of the Inflation Reduction Act

WASHINGTON, D.C. — The Solar Energy Industries Association (SEIA) today filed responses to the U.S. Department of the Treasury’s request for public comments on the clean energy tax provisions of the landmark ...

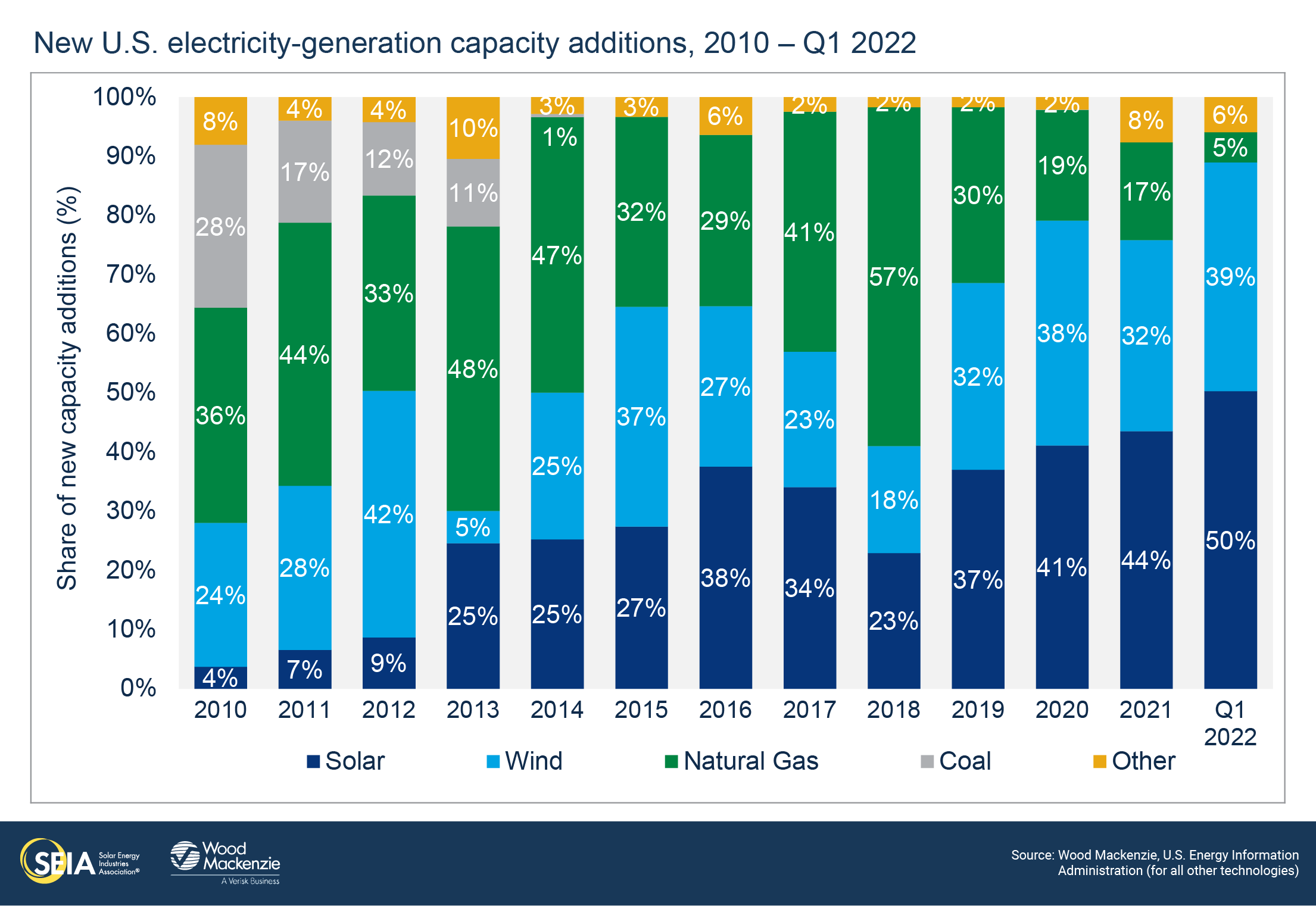

Solar Market Insight Report 2022 Q2

The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight report shows the major trends in the U.S. solar industry. Learn more about the U.S. Solar Market Insight Report. Released June 7, 2022.