1. Key figures

- In Q3 2024 , the U.S solar market installed 8.6 GWdc of capacity, continuing the trend of record-setting quarterly volumes this year. While installations declined 13% quarter-over-quarter, they increased 21% compared to Q3 2023.

- Solar accounted for 64% of all new electricity-generating capacity added to the U.S. grid through Q3 2024. U.S. solar now produces enough electricity annually to power over 37 million homes.

- Domestic module manufacturing capacity increased substantially again in the third quarter, by over 9 GW to nearly 40 At the end of Q2 2022, prior to the passage of domestic manufacturing and procurement tax credits, module manufacturing capacity stood at less than 7 GW – capacity has nearly quintupled since then. The first U.S. cell manufacturing facility opened in Q3, reshoring cell manufacturing in the United States for the first time since 2019.

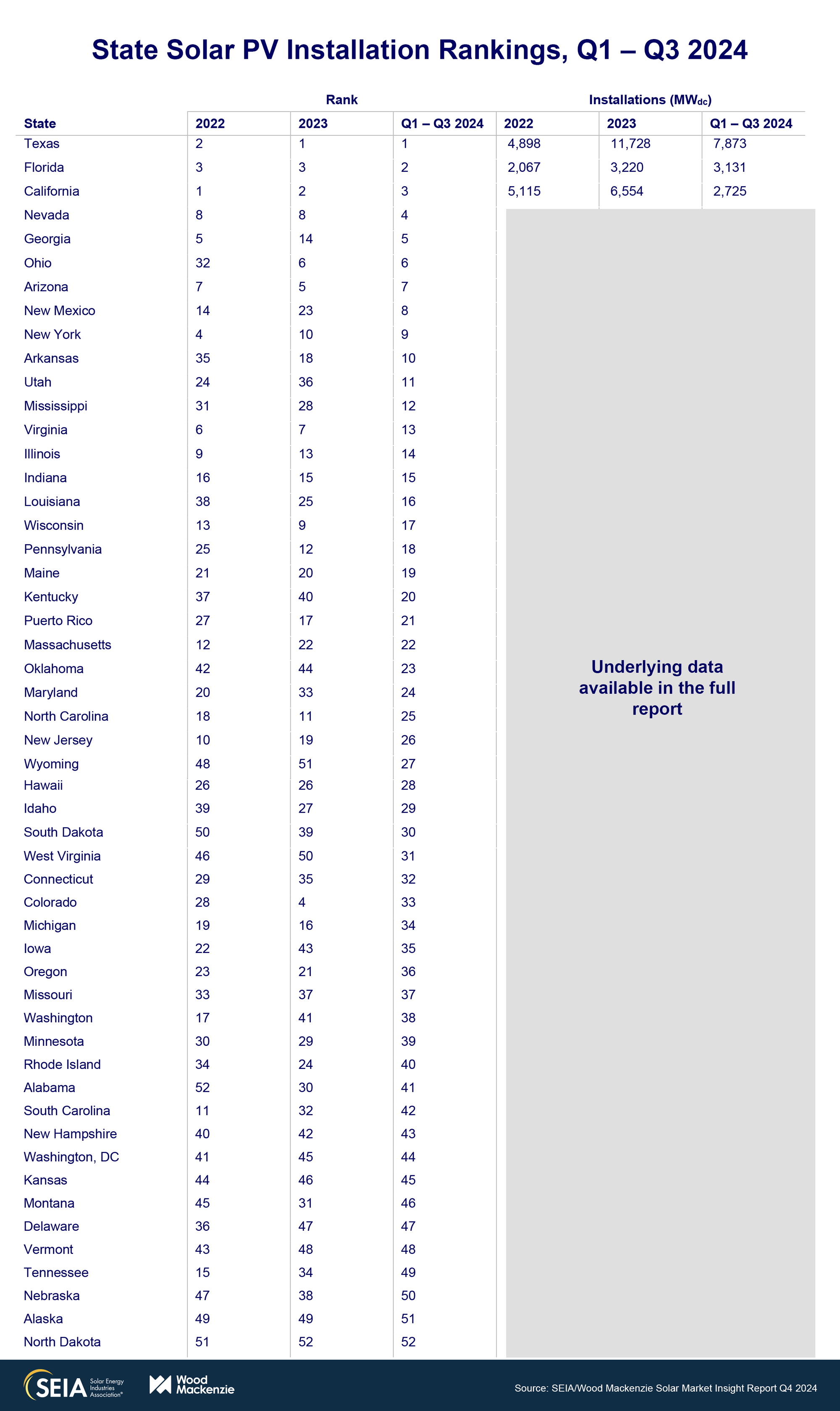

- Texas and Florida continue to be the top-ranked states for capacity installed in 2024 with 7.9 GWdc and 3.1 GWdc online through Q3, respectively.

- The residential segment continued its decline, which started in late 2023, with 1.1 GWdc installed in Q3, a decrease of 4% quarter-over-quarter and 39% year-over-year. Unlike in prior quarters, however, the dip was not driven by California, which experienced a 7% quarter-over-quarter increase. Instead, volumes in most states across the country continued to decline as elevated interest rates and customer uncertainty dampened demand. We now expect a 26% contraction in the residential segment in 2024 compared to 2023.

- The commercial solar segment installed 535 MWdc in Q3 2024, 17% more than in Q2 and 44% more than Q3 2023. Pipeline projects in states like California, Illinois, Maine, and New York finally came online as we approach year-end. The California market continues to see significant deployment from the remaining NEM 2.0 pipeline.

- The community solar segment installed 291 MWdc in Q3 2024, a decline of 17% quarter-over-quarter but a 12% increase year-over-year. Community solar in Maine and Illinois experienced quarterly growth, but this was outweighed by slowing momentum in New York.

- The utility-scale segment installed 6.6 GWdc in Q3 2024, a 16% decline from Q2 2024 and a 44% increase year-over-year. This was the highest third quarter on record for the utility-scale solar industry as developers continue building out a strong pipeline of projects.

- It’s too early to predict the nature and degree of potential policy changes resulting from a new federal government. Given the immense level of uncertainty, the solar outlooks presented in this report reflect the current policy status quo. The solar analyst team at Wood Mackenzie will be tracking these developments closely.

- Our updated forecasts for the current policy status quo show the U.S. solar industry will install 40.5 GWdc in 2024, followed by average annual volumes of at least 43 GWdc from 2025-2029. This year, installations are expected to decline slightly (2%), driven mostly by the expected 26% decline in the residential segment. Despite high demand for solar, we expect growth to remain flat in the next five years as the industry continues to be constrained by broader power sector challenges: a lack of labor availability, high voltage equipment constraints, and interconnection delays.

2. Introduction

The U.S. solar industry installed 8.6 gigawatts-direct current (GWdc) of capacity in the third quarter of 2024, increasing 21% year-over-year and declining 13% quarter-over-quarter. We predict the industry will install another 10 GWdc in the fourth quarter to reach an annual total of 40.5 GWdc a slight increase from our previous projection.

The residential solar segment continued its downward trend, declining 4% since last quarter. But unlike prior quarters, the decline was not driven by California, which experienced a 7% quarter-over-quarter increase. Installation volumes are down in most states nationwide as elevated interest rates and customer uncertainty continued to dampen demand. Commercial solar had a strong quarter, with 535 MWdc energized in Q3 2024, 17% more than in Q2 and a substantial 44% more than a year ago. Projects in states like California, Illinois, Maine, and New York came online as we approach year-end. By contrast, the community solar segment installed 291 MWdc in Q3 2024, a decline of 17% quarter-over-quarter and a 12% increase year-over-year. Quarterly installations were dragged down by a slower quarter in New York. Utility-scale solar had yet another robust quarter, increasing 44% year-over-year with 6.6 GWdc installed. While there have been project delays throughout the year due to various factors, we expect over 7 GWdc of utility-scale solar to come online in Q4 2024, bringing the yearly total to over 31 GWdc.

Overall, photovoltaic (PV) solar accounted for 64% of all new electricity-generating capacity additions through Q3 of this year, making solar the dominant form of new generating capacity in the U.S.

U.S. elections bring uncertainty to the solar market

Come January, there will be a new president in the White House and Republicans will hold majorities in both the House and Senate. With a great deal of uncertainty surrounding the regulatory policy and priorities for budget reconciliation and tax credit legislation in the new Congress, the impacts on the outlook for solar deployment are not yet clear. For this reason, our solar forecasts in this report reflect the current policy status quo. Our base case outlook refrains from predicting the potential policy outcomes from the impending change in government, given the current level of uncertainty. (For more analysis on this topic, see Wood Mackenzie’s post-U.S. election insight.)

The near-term trajectory for solar deployment is unlikely to change significantly, barring any drastic changes. Utility-scale projects and larger commercial solar projects slated to come online in the next 2-3 years are already well underway, likely with an interconnection agreement secured or having already started construction. For distributed solar projects, the sales and installation cycle takes at least a few quarters for residential solar and longer for commercial solar, meaning that near-term volumes are unlikely to be impacted substantially by federal policy changes.

The Wood Mackenzie solar analyst team will be tracking potential changes from the new administration closely. In our 2024 year-in-review report, to be released in Q1 2025, we’ll examine several scenarios for possible outcomes and the implications for the U.S. solar industry.

Third-quarter installations reaffirm our expectations for over 40 GWdc of solar additions in 2024

With residential solar continuing to experience quarterly declines, we expect a 26% contraction this year. This forecast represents a floor for our outlook – installations will recover starting in 2025 and beyond. This recovery will be driven by growth in third-party-owned systems, which has picked up this year and will continue into next year. Product adaptation and expected interest rate cuts will add to the growth momentum (although there is a risk that new federal policies will change Wood Mackenzie’s view on expected interest rate and inflation trends).

Commercial and community solar are expected to grow 13% and 10%, respectively, in 2024. This projected growth is slightly higher than our prior expectations. For commercial solar, healthy third-quarter volumes boosted our outlook for the year. While community solar volumes were down in New York and a handful of other major markets, we’ve raised our outlook for states like Illinois and Maine that saw healthy third-quarter installations.

Finally, our outlook for utility-scale solar has increased slightly to 31.8 GWdc – just above 2023 volumes. The pipeline for utility-scale solar remains robust, but final operation dates hinge on electrical equipment delivery timelines, expensive and complex network upgrades, and negotiations with EPC companies – all factors that are challenging to predict.

Overall, we’ve increased our outlook for the year just slightly to 40.5 GWdc.

Preliminary CVD rates align with industry expectations as supply chains diversify

Last quarter, we incorporated impacts from potential new antidumping and countervailing duties (AD/CVD) on imports of solar modules and cells made in Cambodia, Malaysia, Thailand, and Vietnam (CMTV). We expect these impacts to be minimal given the rapid growth of the global solar manufacturing supply chain that enables buyers to source equipment from non-tariffed countries. Developers either have access to previously imported inventory, growing domestic sources of equipment and non-subject thin film supply, or will be importing equipment from outside the targeted countries.

In October (with additional updates in November), the U.S. Department of Commerce (DOC) released the preliminary determinations for the CVD cases. The “all others” rates (applied to any imports from companies that are not assigned a company-specific rate) range from 2.85% to 23.06% for the four countries. This generally aligns with the industry’s expectations for these tariff rates. And many large suppliers were assigned rates lower than the “all others” rates. In late November, the DOC also released preliminary determinations for the AD cases. The “all others” rates range from 18% to 271% for the four countries. Some rates are in line with industry expectations while certain rates are higher. Wood Mackenzie will continue to track the impacts of these cases closely. Overall, the supply of key solar components continues to grow with options for buyers outside the impacted countries, including in the U.S.

Industry remains on track to grow modestly over the next five years

Our current outlook for the next five years has the US solar industry growing 2% per year on average. The industry will install at least 43 GWdc from 2025 onward and reach a cumulative total of nearly 450 GWdc by the end of 2029. Demand for solar remains robust, and annual installation forecasts would be higher if not for limitations facing the industry, including those related to interconnection, labor availability, supply constraints, and policy.

There is always the potential for policy changes to impact deployment but solar is currently the dominant form of new energy generating capacity in the U.S. The benefits of solar – its cost competitiveness, benefits to the environment, low water use, and continuously improving technology, to name a few – have spurred demand from utilities, IPPs, and corporate offtakers who see solar as the path to US energy independence. (For more information on the latest corporate solar adoption trends, read SEIA’s 2024 Solar Means Business report).

3. Market segment outlooks

3.1. Residential PV

- 1,128 MWdc in Q3 2024

- Down 39% from Q3 2023

- Down 4% from Q2 2024

Low Q3 installations reflect the residential solar market’s continued woes, but recovery is in sight

In Q3 2024, the residential solar market added 1,128 MWdc, a 39% year-over-year decline. Based on the first three quarters of the year, total residential installed capacity fell by 33% compared to the same timeframe in 2023, with 39 state markets contracting. Installer and financier bankruptcies this year contributed to lower installation volumes, as two of the top-ranked installers from 2023 exited the market, leaving sales pipelines and orphaned projects that will take time for other companies to take over. Some installers report that sales this summer did not increase as significantly as in years past. This can be attributed to consumers waiting for interest rates to fall, hesitancy ahead of the election, and milder weather in some areas of the country, leading to lower residential energy bills. Although interest rates dropped by 50 basis points in September (and by 25 basis points in November), there were no notable changes to financing rates or consumer activity.

Many installers also do not expect their installation volumes to grow in 2024 compared to last year. Based on continued low capacity in the third quarter, we have reduced our 2024 outlook further by another 9%, and we now expect a 26% reduction in annual installed capacity. Even with a more robust fourth quarter, the segment will contract significantly in 2024, as interest rate cuts occurred later in the year and were not as impactful as expected. While the California residential solar market started to recover in the third quarter, the state’s residential installations will still decline by approximately 40% this year.

There is positive momentum and cautious optimism for the residential solar market heading into 2025. While slower sales earlier in the year led to fewer installations in 2024, some installers report that sales volumes have increased in the second half, which will drive recovery in 2025 as these projects are installed. Wood Mackenzie expects the residential solar market to add more than 6 GWdc and grow by 21% in 2025. This is driven by numerous tailwinds, which include a stabilizing California market (albeit at a lower level), momentum from interest rate cuts, loan market recovery, a burgeoning third-party ownership segment with new players and unique product offerings, and a rush to qualify projects for the domestic content ITC adder. We expect this recovery to continue into 2026 as the market grows by 18%. Longer term, the market will grow at an average annual rate of 9% between 2027-2029, slowing slightly towards the end of our outlook as market penetration approaches higher levels in some states.

3.2. Commercial PV

- 535 MWdc installed in Q3 2024

- Up 17% from Q3 2023

- Up 44% from Q2 2024

Note on market segmentation: Commercial solar encompasses distributed solar projects with commercial, industrial, agricultural, school, government, or nonprofit offtakers, including remotely net-metered projects. This excludes community solar (covered in the following section).

The commercial solar market had a record-breaking third quarter, driving 13% expected growth in 2024

The commercial solar market had a strong third quarter, adding 535 MWdc, an increase of 44% year-over-year and 17% quarter-over-quarter. This was mostly fueled by California’s NEM 2.0 projects continuing to come online, but other states such as Illinois, New York, and Maine also experienced tremendous growth this quarter. Less mature commercial solar markets, such as Arkansas, Delaware, Michigan, Oklahoma, and Washington, also had healthy installation volumes.

Developers are becoming increasingly creative in finding ways to make project economics work in their favor. Rural Energy for America Program grants have gained popularity because they improve commercial solar project economics in rural America. We have seen upticks in installation volumes in states such as Iowa, North Carolina, and other rural states, thanks to these grants. Additionally, universities are driving commercial solar, with schools such as Brown University in Rhode Island and Emory University in Georgia installing solar on their campuses this year.

We have made significant adjustments to our commercial solar forecast this quarter, mostly in the near term. California’s NEM 2.0 projects continue to come online but are taking longer than initially estimated. Compared to our previous forecast, we now expect commercial solar installations in California to continue growing through 2025. As a result, a decline in the state’s installations will not occur until 2026. For states outside of California, prevailing wage and apprenticeship requirements will contribute to a slowdown in 2025. Since new projects larger than 1 MWac must meet these requirements to qualify for the full tax credits, many developers began construction on a significant portion of their active pipeline before requirements took effect in January 2023. Much of this pipeline will have been built by 2025, resulting in slightly reduced volumes from 2025 through 2027. The national commercial solar market will grow by 19% annually in 2028 and 18% in 2029. This growth is driven by heightened development activity, particularly in the largely untapped Midwest and Southeast markets.

3.3. Community solar PV

- 291 MWdc installed in Q3 2024

- Up 12% from Q3 2023

- Down 17% from Q2 2024

Note on market segmentation: Community solar projects are part of formal programs where multiple residential and non-residential customers can subscribe to the power produced by a local solar project and receive credits on their utility bills.

Installed capacity in Illinois and New York drive 10% national annual community solar growth in 2024

Community solar installations increased 12% year-over-year in Q3 2024, resulting in 291 MWdc of new capacity. Capacity additions continue to be highly concentrated within a few state markets. New York and Maine comprised 38% and 22% of Q3 2024 volumes, respectively. New capacity in Illinois totalled 54 MWdc – the state’s largest quarter since Q2 2021. Due to historical data lags, H1 2024 installation volumes were stronger than reported last quarter, totalling 670 MWdc – a 26% increase compared to H1 2023. Driven by these historical changes and strong quarterly growth in top markets, we now expect 10% national annual growth in 2024, with cumulative community solar volumes expected to break 8 GWdc.

Going forward, community solar volumes will level off through 2026. While pipeline capacity in the top three markets now totals over 7 GWdc, interconnection constraints significantly hinder how much and how quickly this capacity can be realized. For example, in New York, community solar projects now take an average of 35 months to reach completion – a 48% increase compared to 2020. Current levels of installation growth cannot be sustained without significant interconnection reform. In response to market saturation, developers are beginning to seek new origination opportunities outside of top markets, but options are limited. Community solar development in Maryland, New Jersey, and Delaware is ramping up; however, these markets are currently too small to make up for declines in larger markets long-term.

After 10% annual growth in 2024, we expect the community solar market to contract at an average annual rate of 5% through 2029, with cumulative capacity on track to break 15 GWdc by 2030. Importantly, our five-year outlook includes only state markets with programs currently in place and does not include those with proposed program legislation, leaving upside potential if new legislation is passed. The $7 billion of Solar for All funding, which granted awards to 60 successful applicants, could also provide further upside to the outlook once implementation plans are finalized.

3.4. Utility PV

- 6.6 GWdc installed in Q3 2024

- Up 44% from Q3 2023

- Over 195 GWdc of utility-scale solar will be added between 2024 and 2029

Utility-scale segment maintains installation momentum, but projects in 2024 still face risk of delays

The utility-scale sector achieved its strongest third quarter on record with 6.6 GWdc of capacity installed in Q3 2024, representing 44% year-over-year growth. The contracted pipeline remains steady, with 5.3 GWdc of newly contracted projects in Q3 2024, a 120% year-over-year increase. This is the first year-over-year increase observed for contracted utility-scale projects in the third quarter since 2019. However, the total contracted pipeline declined 1% from last quarter to 74 GWdc, as installation volumes slightly exceeded newly contracted projects.

Wood Mackenzie forecasts that 195 GWdc of new utility-scale solar will come online between 2024-2029. This represents a 5% increase compared to our previous forecast. This 9 GWdc increase to our outlook is driven by a strong pipeline of projects that had experienced delays but are currently undergoing construction in the second half of 2024. We expect these delayed projects to materialize in 2025 and 2026. The pipeline of projects is concentrated in key states like Arizona, California, Illinois, Michigan, and Texas. Some states, like Illinois, Washington, Oregon, and Oklahoma, are expected to have their first GW plus-sized projects come online in 2028 and 2029.

Our current forecast reflects the policy status quo. We expect strong demand in the utility-scale sector, driven mainly by utility and corporate procurements, to drive an average annual buildout of 33 GWdc throughout our five-year outlook. Outside of policy changes, utility-scale solar will continue to be limited by a lack of labor availability, constraints on the supply of high-voltage equipment, and interconnection delays.

4. U.S. solar PV forecasts

5. National solar PV system pricing

- Residential system pricing is down 4% year-over-year

- Commercial system pricing is down 12% year-over-year

- Utility-scale system pricing is up 1% for fixed-tilt and 2% for single-axis tracking year-over-year

Wood Mackenzie employs a bottoms-up modeling methodology to capture, track and report national average PV system pricing by segment for systems installed each quarter. The methodology is based on the tracked wholesale pricing of major solar components and data collected from industry interviews. Wood Mackenzie’s Supply Chain data and models are leveraged to enhance and bolster our pricing outlooks. New this quarter: Wood Mackenzie assumes that all system costs are incurred in the year in which the project is being contracted and no procurement or construction lags are being factored into the pricing. Module prices for all segments are also now reflective of ‘overnight’ pricing and do not account for any procurement or delivery lags (previously, modules for the utility segment were assumed to be procured one year prior to the project’s commercial operation). The utility segment data no longer breaks out taxes as a separate line item as those are incorporated in the equipment category estimates. These changes have been made to the current system prices as well as historical 2023 prices.

The distributed generation (DG) segment experienced year-over-year declines in system prices. The residential segment was down 4% to $3.33/Wdc, and the commercial segment was down 12% to $1.44/Wdc in Q3 2024. Despite increased costs across the balance-of-plant categories such as labor, engineering and customer acquisition, the total system price decreased as module prices declined by 35% year-over-year, averaging $0.31/Wdc in Q3 2024 for the DG segments.

The utility segment’s system price was $1.06/Wdc for fixed-tilt and $1.20/Wdc for single-axis tracking systems in Q3 2024, up 1% and 2%, respectively, compared to Q3 2023. Module price declines for this segment were offset by higher labor costs as EPCs worked to meet the prevailing wage and apprenticeship requirements (PWA) for IRA incentives, resulting in higher overhead costs to demonstrate compliance with the requirement. Rising wages due to inflation and an ongoing labor shortage increased labor costs by 10% annually in 2024.

License

Ownership rights

This report (“Report”) and all Solar Market Insight® (“SMI”)TM reports are jointly owned by Wood Mackenzie and the SEIA® (jointly, “Owners”) and are protected by United States copyright and trademark laws and international copyright/intellectual property laws under applicable treaties and/or conventions. Purchaser of Report or other person obtaining a copy legally (“User”) agrees not to export Report into a country that does not have copyright/intellectual property laws that will protect rights of Owners therein.

Grant of license rights

Owners hereby grant user a non-exclusive, non-refundable, non-transferable Enterprise License, which allows you to (i) distribute the report within your organization across multiple locations to its representatives, employees or agents who are authorized by the organization to view the report in support of the organization’s internal business purposes, and (ii) display the report within your organization’s privately hosted internal intranet in support of your organization’s internal business purposes. Your right to distribute the report under an Enterprise License allows distribution among multiple locations or facilities to Authorized Users within your organization.

Owners retain exclusive and sole ownership of this report. User agrees not to permit any unauthorized use, reproduction, distribution, publication or electronic transmission of any report or the information/forecasts therein without the express written permission of Owners.

Disclaimer of warranty and liability

Owners have used their best efforts in collecting and preparing each report.

Owners, their employees, affiliates, agents, and licensors do not warrant the accuracy, completeness, correctness, non-infringement, merchantability, or fitness for a particular purpose of any reports covered by this agreement. Owners, their employees, affiliates, agents, or licensors shall not be liable to user or any third party for losses or injury caused in whole or part by our negligence or contingencies beyond Owners’ control in compiling, preparing or disseminating any report or for any decision made or action taken by user or any third party in reliance on such information or for any consequential, special, indirect or similar damages, even if Owners were advised of the possibility of the same. User agrees that the liability of Owners, their employees, affiliates, agents and licensors, if any, arising out of any kind of legal claim (whether in contract, tort or otherwise) in connection with its goods/services under this agreement shall not exceed the amount you paid to Owners for use of the report in question.