Solar Market Insight Report 2021 Q2

The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market InsightTM report shows the major trends in the U.S. solar industry. Learn more about the U.S. Solar Market Insight Report. Released June 15, 2021.

1. Key Figures

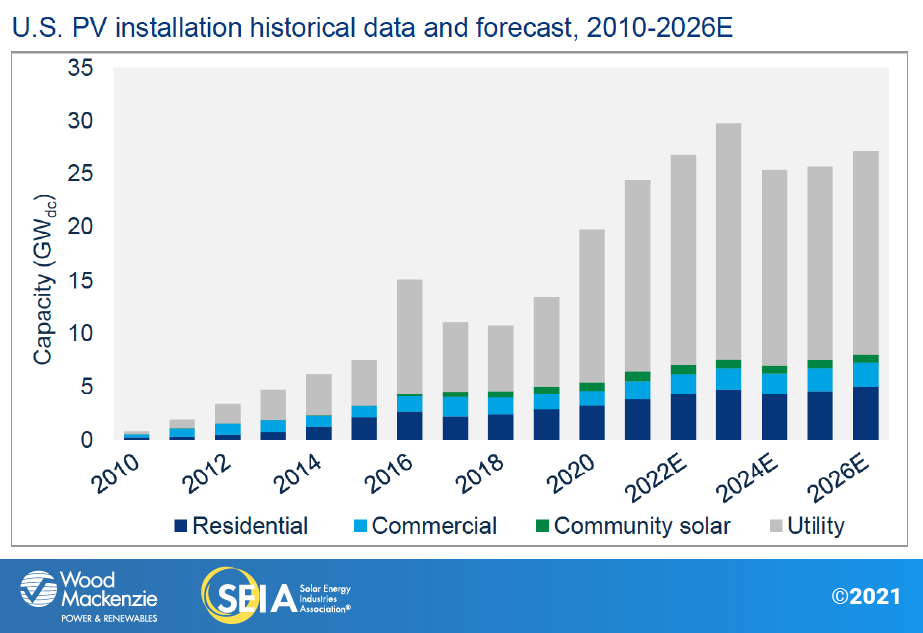

- In Q1 2021, the U.S. solar market installed just over 5 GWdc of solar capacity, a 46% increase over the first quarter of 2020 and the largest Q1 on record.

- With Q1 additions, cumulative solar capacity in the U.S. has officially surpassed 100 GWdc and is expected to pass 100 GWac next year.1

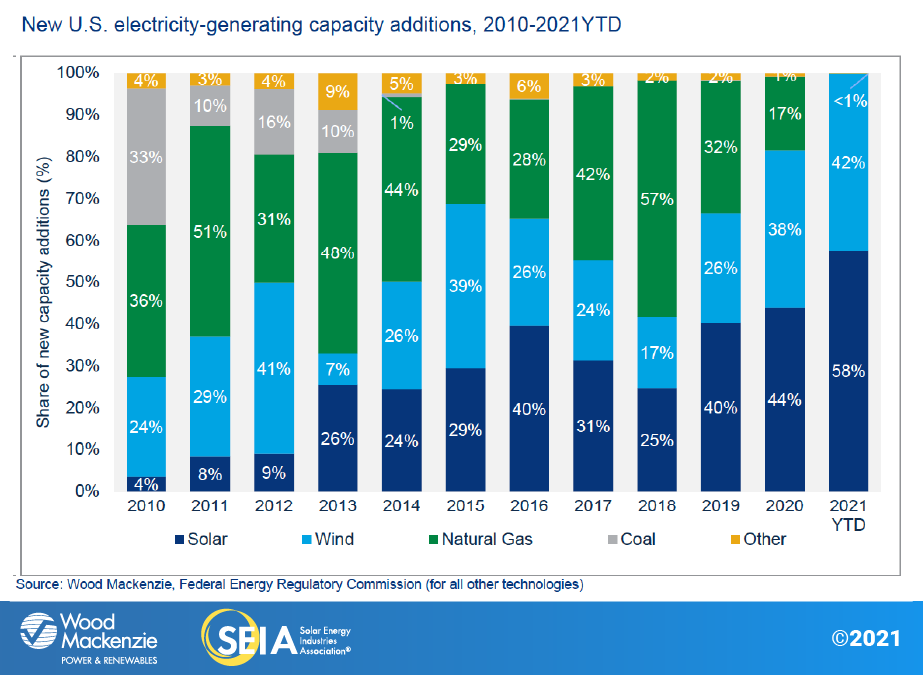

- Solar accounted for 58% of all new electricity-generating capacity added in the U.S. in Q1 2021, with wind making up most of the remainder.

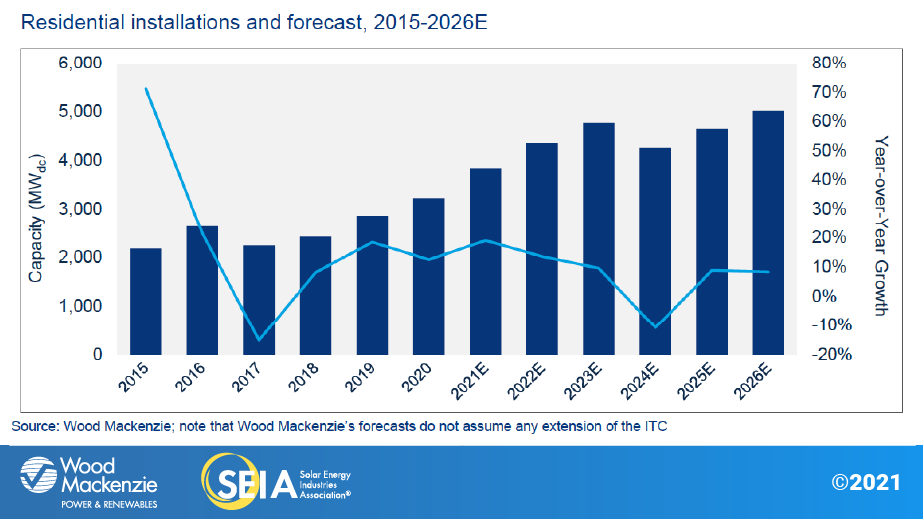

- Residential solar was down 8% from Q4 2020, but up 11% from Q1 2020 with 905 MWdc installed, thanks to healthy sales pipelines that spilled over into the first quarter.

- Commercial solar and community solar volumes declined from Q4 2020, as is typical for these market segments. Commercial solar increased 19% over Q1 2020 and community solar declined 15% from Q1 2020.

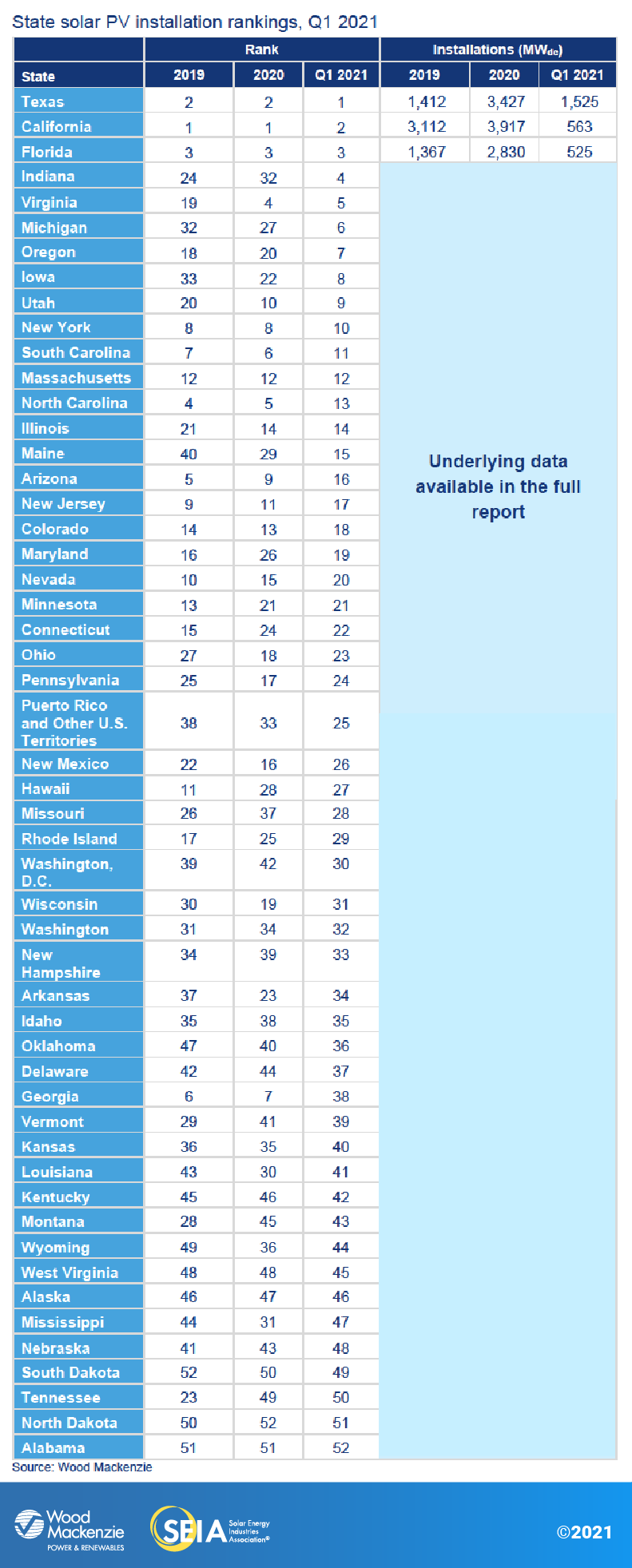

- Utility-scale solar set a record for first-quarter installations at 3.6 GWdc. Texas made up the largest share of this capacity, with more than 1.4 GWdc of installations.

- A total of 6.2 GWdc of new utility-scale solar power purchase agreements were announced in Q1 2021, on par with Q1 2020. The total utility-scale contracted pipeline has grown to nearly 77 GWdc.

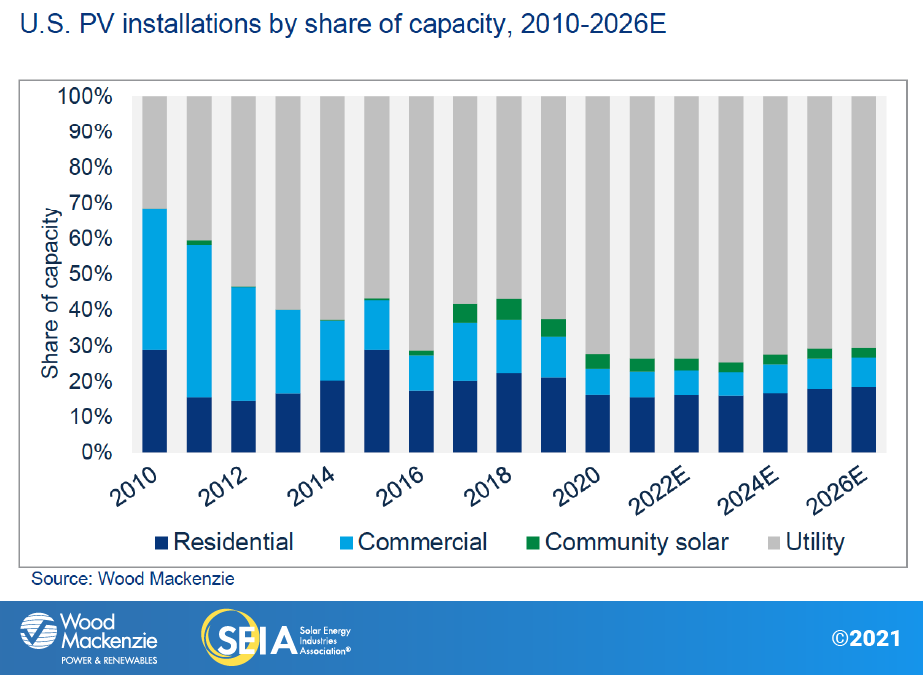

- Wood Mackenzie forecasts that the solar industry will continue to break annual installation records every year for the next three years before the investment tax credit (ITC) fully phases down under current law. Another 160 GWdc of capacity will be installed between 2021 and 2026 to accompany today’s current operational fleet of over 100 GWdc. This will bring the total operating PV fleet to over 250 GWdc by the end of 2026.

1Photovoltaic systems have a direct current (DC) rating based on the total DC capacity of all the panels and an alternating current (AC) rating based on the rated capacity of all inverters that convert DC to AC for use on the grid. This DC:AC ratio or inverter loading ratio (ILR) is a design choice made to optimize project economics and varies from system to system. This report series uses DC capacity to report on the volume of activity in the solar energy industry. All generating technologies connect to the grid with an AC interconnection.

2. Introduction

Note on market segmentation: Beginning with the Q2 2021 report, Wood Mackenzie has modified how we cover specific market segments. The former “non-residential” segment has been split into “commercial solar” and “community solar.” See more specific definitions in the market segment outlook sections. We continue to use “non-residential” to refer to these two market segments combined.

In the first quarter of 2021, the U.S. solar industry installed just over 5 GW-direct current (GWdc) of capacity, the largest first quarter on record. The first quarter of the year typically brings a slowdown in installations after the year-end push. While Q1 2021 followed this same pattern, all market segments except community solar grew compared with Q1 2020.

Residential solar volumes grew 11% over Q1 2020 but declined from a record Q4 2020. Commercial solar grew 19% over Q1 2020, while utility solar set a record for the largest first quarter in history. And while community solar declined year-over-year, that market segment is still expected to reach record-setting installations this year. Finally, solar PV accounted for 58% of all new electricity-generating capacity additions in Q1 2021.

Supply chain constraints start to hit the solar industry

Over the last several quarters, critical components for solar equipment – polysilicon, steel, aluminum, semiconductor chips, copper and other metals – have become increasingly supply-constrained. The dynamics around each commodity are nuanced. But increasing demand for solar, combined with pandemic-related macroeconomic realities (such as increased shipping costs, microchip availability, and a residential home renovation boom) have led to increased commodity prices and delivery delays.

The impacts of these constraints on the solar industry vary. The price of steel has more than doubled since the pandemic began, which has led to increased prices and lowered availability of solar racking equipment and trackers. To date, this has mostly affected utility-scale solar projects but has also impacted carport installations, which require more steel support structures than other solar projects. Polysilicon supply and demand are barely balanced, so small production errors can make an outsized difference. This has led to stagnant or increasing module costs (depending on the manufacturer), reversing a decades-old trend of module cost declines.

Generally, there is a lag between changes to commodity prices and subsequent changes to solar system prices. The extent to which commodity price increases are passed onto customers can vary. But through Q1, the effects on installed solar system prices have been marginal.

This is not to say there haven’t been impacts from commodity price increases and equipment delays, and those impacts vary by market segment. The effects on distributed solar, for instance, have been more muted. A few additional cents per watt in module costs represent a relatively small percent increase in total costs for residential and commercial installers. And many developers have work pipelines strong enough to accommodate a few weeks’ delay in equipment deliveries. But compounding cost increases across all materials are just beginning to affect installers. Developers of distributed solar-plus-storage projects have started to report months-long installation delays stemming from constrained battery supplies.

The most significant impact of the current supply environment is on utility-scale projects that are under development. Developers are approaching offtakers to renegotiate their PPAs to increase prices or relax online dates. So far, efforts to increase PPA prices on existing contracts have not been very successful in a hyper-competitive market. This will be an important issue to watch throughout 2021 and beyond.

Biden’s infrastructure plan is a big upside for solar – it it’s passed

In late March, President Biden published The American Jobs Plan – a sweeping plan to upgrade the nation’s infrastructure while creating jobs. The most important parts of the plan for the solar industry include extending the ITC and expanding the credit to include direct-pay, extending the production tax credit, incentives to build out the transmission grid, and a target to make the electric sector 100% carbon-free by 2035. These are big proposals, any of which would have significant implications for the solar industry. Which policies Congress includes in upcoming legislation remains to be seen, and we will track potential impacts on the industry as this moves forward.

3. Market segment outlooks

3.1. Residential PV

Key figures

- 905 MWdc installed in Q1 2021, the largest first quarter on record

- Up 11% from Q1 2020

- Down 8% from Q4 2020

Residential solar had its largest-ever first quarter and second-largest quarter in history, setting up 2021 to be the biggest year yet for the market. Florida and Arizona had record-breaking quarters, while Texas set a new first-quarter record (despite losing a week of activity during the February winter storm).

Many installers reported that project backlogs stabilized throughout the quarter after having grown to borderline unsustainable levels during the latter half of 2020. Issues related to obtaining permits and gaining permission to operate have eased somewhat. Companies are now focused on scaling operations to keep up with growing sales activity. Early signs show that this spring’s sales season is breaking records. But the market is not uniform – some installers have only just returned to pre-pandemic sales levels.

Consumer demand for residential solar remains stronger than ever. Wood Mackenzie forecasts the residential market will grow 19% year-over-year, resulting in more than 3.8 GWdc of installed capacity in 2021. The two-year ITC extension will drive double-digit growth in 2022 and 2023, with improved economics for customer-owned systems during this period boosting solar loans. The market will take a couple of years to recover post-ITC-stepdown before eclipsing 5 GWdc for the first time in 2026.

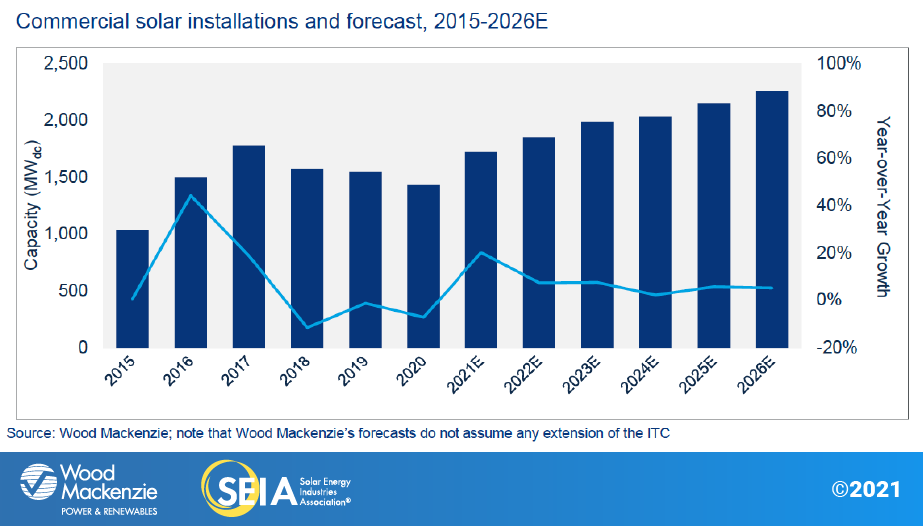

3.2. Commercial PV

Key figures

- 347 MWdc installed in Q1 2021

- Up 19% from Q1 2020

- Down 35% from Q4 2020

Note on market segmentation: Beginning with the Q2 2021 report, Wood Mackenzie has modified how we cover specific market segments. The former “non-residential” segment has been split into “commercial solar” and “community solar.” Commercial solar encompasses distributed solar projects with commercial, industrial, agricultural, school, government or nonprofit offtakers, including remotely net-metered projects.

Commercial solar had a decent start to the year with first-quarter installations at their highest level since 2018. States with healthy capacity additions included California, Illinois, and New York. There are still certain customer segments that are in recovery mode, with insufficient credit for solar project financing. At the same time, there is a surge in interest in environment, social, and governance (ESG) investments. For some developers, this has helped increase lead generation.

Looking ahead, commercial solar is at an interesting juncture with 2021 installations expected to grow 20% over 2020. This is colossal growth for a market that has declined for three years in a row. The extended ITC certainly contributes to this forecast. But more important, multiple state-level incentive programs are culminating this year, resulting in record growth. These large pipelines have also led to the most significant challenge facing commercial solar (and community solar) today: interconnection costs and upgrades. Beyond 2021, growth averages 6% annually as pipelines are built out and incentives are used up.

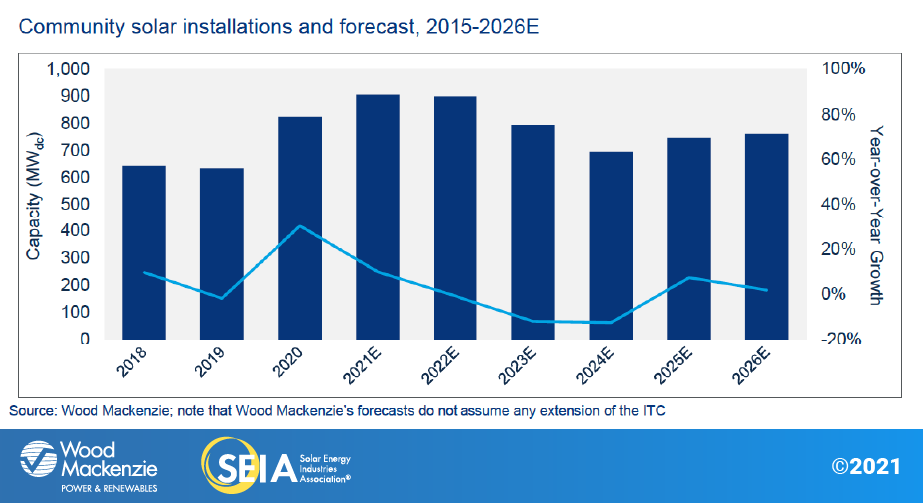

3.3. Community solar PV

Key figures

- 131 MWdc installed in Q1 2021

- Down 15% from Q1 2020

- Down 68% from Q4 2020

Note on market segmentation: Beginning with the Q2 2021 report, Wood Mackenzie has modified how we cover specific market segments. The former “non-residential” segment has been split into “commercial solar” and “community solar.” Community solar projects are part of formal programs where multiple customers can subscribe to the power produced by a local solar project and receive credits on their utility bills.

Installation levels were modest across most community solar markets in Q1 2021. But lower first-quarter volumes are not necessarily indicative of a long-term trend. Rather, current interconnection and siting challenges, new and transitioning programs, and policy uncertainty are leading to delays in bringing projects online. This year is expected to set the record for annual community solar installations at 909 MWdc. As current interconnection issues in states such as Maine and Massachusetts are disentangled, high volumes of pent-up capacity will come online. Meanwhile, much of New York’s allocated Community Adder capacity is expected to be interconnected this year. Finally, despite a slow start to the first year of New Jersey’s community solar pilot program, the state should begin bringing dozens of megawatts online in the coming months.

We have increased the five-year community solar outlook by 16% since last quarter’s forecast. Robust growth of interconnection queues as developers continue to add projects to their pipelines in states like New Jersey, Maine, and Illinois will lead to high volumes over the next few years.

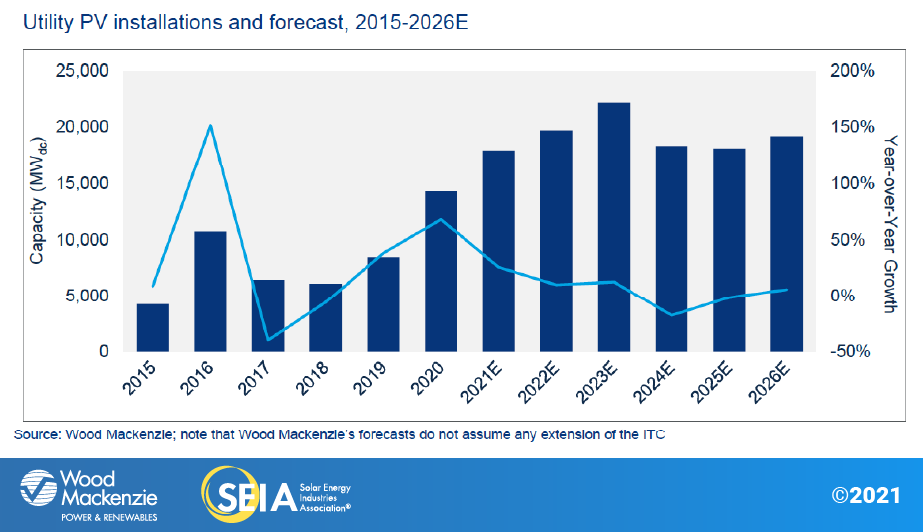

3.4. Utility PV

Key figures

- 3.63 GWdc installed in Q1 2021, the largest first quarter on record

- 6.2 GWdc of new utility-scale solar contracts were signed

- The contracted pipeline now totals nearly 77 GWdc

The utility solar sector had the largest first quarter on record with 3.63 GWdc installed. The momentum from a strong 2020 has carried into 2021. There are 17 GWdc of projects under construction, 10.6 GWdc of which are slated to come online this year, putting the market on pace to hit a record-breaking 17.9 GWdc of annual capacity additions in 2021.

The ITC extension in late 2020 created tailwinds for the utility-scale solar market even as the segment was expected to break records in each of the next three years. In the first quarter of 2021, 6.2 GWdc of new contracts were signed, adding to the already historic project pipeline. The sector will see double-digit year-over-year growth through 2023 as developers build out pipelines that accrued under earlier ITC deadlines. The market is still responding to the year-end ITC extension, which pushed out the safe harbor installation deadline to the end of 2025. As a result, annual installations are currently expected to decline in 2024 but remain at 18-19 GWdc until 2026.

Multiple factors may create upside and downside pressure to this forecast. On the positive side, President Biden’s proposals to improve American infrastructure, if passed by Congress, will give a significant boost to the renewable energy industry, including solar. But the industry faces headwinds such as high component costs, global logistics challenges, tax equity supply shortages and EPC (engineering, procurement, and construction) capacity constraints that could be exacerbated by new labor requirements.

4. U.S. solar PV forecasts

5. National solar PV system pricing

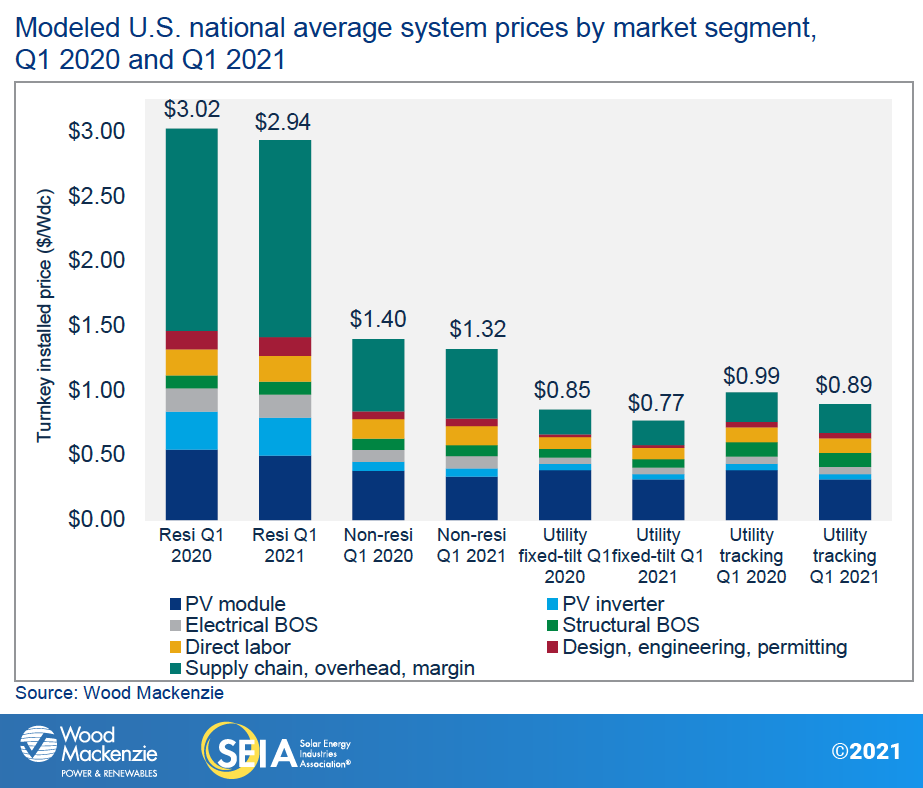

We employ a bottom-up modeling methodology to capture, track and report national average PV system pricing by segment for systems installed each quarter. Our methodology is based on the tracked wholesale pricing of major solar components and data collected from industry interviews. We report a weighted average of multi-silicon and mono PERC solar modules for the non-residential and utility segments, and a weighted average of standard mono PERC and high-efficiency modules for the residential segment.

In Q1 2021, system pricing fell both year-over-year and quarter-over-quarter across all market segments. System pricing fell quarter-over-quarter by 1.1%, 2.9%, 3.7% and 3.6% in the residential, non-residential, utility fixed-tilt and utility single-axis tracking markets, respectively.

Average system prices remained relatively stable from Q4 2020 to Q1 2021, despite the supply chain and logistics constraints that the solar industry faces today. The impact from these bottlenecks had not yet fully manifested into system prices as of Q1. Important raw material inputs to the solar supply chain include steel, aluminum and copper. Price increases for manufacturers may not be felt immediately by customers due to time lags in procuring equipment and long-term supply agreements. Further, manufacturers may still be estimating how much of these price increases they want to pass along to the customer, and how much they decide to absorb.

About the Report

U.S. solar market insight® is a quarterly publication of Wood Mackenzie and the Solar Energy Industries Association (SEIA)®. Each quarter, we collect granular data on the U.S. solar market from nearly 200 utilities, state agencies, installers and manufacturers. This data provides the backbone of this U.S. Solar Market Insight® report, in which we identify and analyze trends in U.S. solar demand, manufacturing and pricing by state and market segment over the next five to ten years. All forecasts are from Wood Mackenzie, Limited; SEIA does not predict future pricing, bid terms, costs, deployment or supply. The report includes all 50 states and Washington, D.C. National totals reported also include Puerto Rico and other U.S. territories. Detailed data and forecasts for 50 states and Washington, D.C. are contained within the full version of the report.

References and Contact

-

References, data, charts and analysis from this executive summary should be attributed to “Wood Mackenzie/SEIA U.S. solar market insight®.”

-

Media inquiries should be directed to Wood Mackenzie’s PR team (WoodmacPR@woodmac.com) and Morgan Lyons (mlyons@seia.org) at SEIA.

-

All figures are sourced from Wood Mackenzie. For more detail on methodology and sources, click here.

About the Authors

Wood Mackenzie Power & Renewables | U.S. Research Team

Michelle Davis, Principal Analyst (lead author)

Bryan White, Solar Analyst

Rachel Goldstein, Solar Analyst

Xiaojing Sun, Principal Analyst

Molly Cox, Solar Analyst

Kelsey Gross, Solar Analyst

Ravi Manghani, Global Head of Solar

Solar Energy Industries Association | SEIA

Shawn Rumery, Director of Research

Colin Silver, Chief of Staff and Chief Content Officer

Justin Baca, Vice President of Markets & Research

Note on U.S. solar market insight report title: WM P&R and SEIA have changed the naming convention for the U.S. solar market insight report series. Starting with the report released in June 2016 onward, the report title will reference the quarter in which the report is released, as opposed to the most recent quarter in which installation figures are tracked. The exception will be our year in review publication, which covers the preceding year’s installation volumes despite being released during the first quarter of the current year.

License

Ownership rights

This report (“Report”) and all Solar Market Insight® (“SMI”)TM reports are jointly owned by Wood Mackenzie and the Solar Energy Industries Association (SEIA)®(jointly, “Owners”) and are protected by United States copyright and trademark laws and international copyright/intellectual property laws under applicable treaties and/or conventions. Purchaser of Report or other person obtaining a copy legally (“User”) agrees not to export Report into a country that does not have copyright/intellectual property laws that will protect rights of Owners therein.

Grant of license rights

Owners hereby grant user a non-exclusive, non-refundable, non-transferable Enterprise License, which allows you to (i) distribute the report within your organization across multiple locations to its representatives, employees or agents who are authorized by the organization to view the report in support of the organization’s internal business purposes, and (ii) display the report within your organization’s privately hosted internal intranet in support of your organization’s internal business purposes. Your right to distribute the report under an Enterprise License allows distribution among multiple locations or facilities to Authorized Users within your organization.

Owners retain exclusive and sole ownership of this report. User agrees not to permit any unauthorized use, reproduction, distribution, publication or electronic transmission of any report or the information/forecasts therein without the express written permission of Owners.

Disclaimer of warranty and liability

Owners have used their best efforts in collecting and preparing each report.

Owners, their employees, affiliates, agents, and licensors do not warrant the accuracy, completeness, correctness, non-infringement, merchantability, or fitness for a particular purpose of any reports covered by this agreement. Owners, their employees, affiliates, agents, or licensors shall not be liable to user or any third party for losses or injury caused in whole or part by our negligence or contingencies beyond Owners’ control in compiling, preparing or disseminating any report or for any decision made or action taken by user or any third party in reliance on such information or for any consequential, special, indirect or similar damages, even if Owners were advised of the possibility of the same. User agrees that the liability of Owners, their employees, affiliates, agents and licensors, if any, arising out of any kind of legal claim (whether in contract, tort or otherwise) in connection with its goods/services under this agreement shall not exceed the amount you paid to Owners for use of the report in question.

Publisher SEIA, Wood Mackenzie Power & Renewables