Solar Market Insight Report 2020 Q2

The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market InsightTM report shows the major trends in the U.S. solar industry. Learn more about the U.S. Solar Market Insight Report. Released June 11, 2020.

1. Key Figures

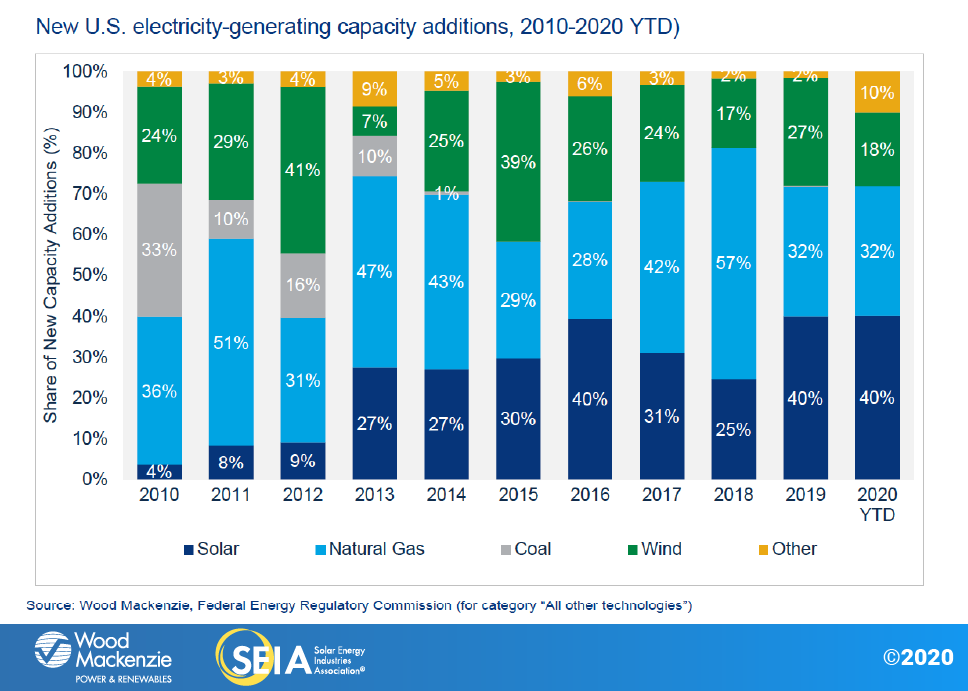

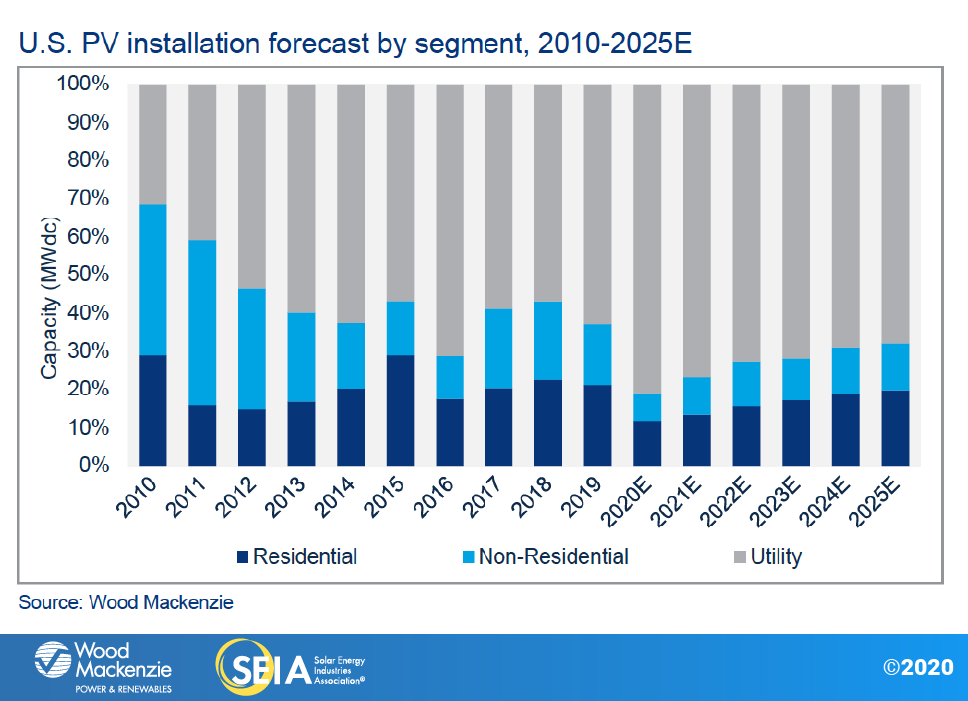

- Solar accounted for 40% of all new electricity generating capacity added in the U.S. in Q1 2020, similar to the share of new capacity added in 2019.

- The first quarter of the year was largely unaffected by the coronavirus pandemic, but impacts are expected to appear beginning in the second quarter.

- In Q1 2020, the U.S. solar market installed 3.6 GWdc of solar PV, the largest Q1 on record by more than 1 gigawatt.

- A total of 5.4 GWdc of new utility PV projects were announced in Q1 2020, indicating strong demand through the first quarter of the year.

- The impact of the coronavirus pandemic has been felt most acutely in distributed solar, which is expected to see 31% fewer installations in 2020 than in 2019 as installers face work stoppages and sales strategy transitions and the impending recession reduces consumer and business appetite for large investments.

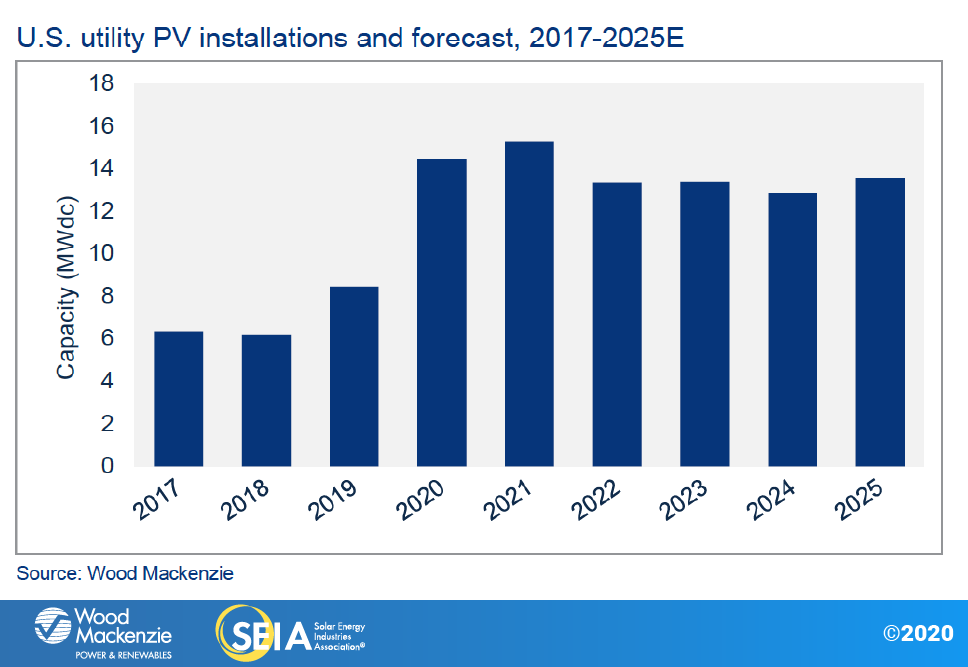

- While the U.S. utility PV segment is expected to add 14.4 GWdc this year, many projects are on delayed timelines due to the pandemic.

- Community solar continues to expand its geographic diversification, with New York becoming the third market to exceed 300 MWdc of community solar capacity.

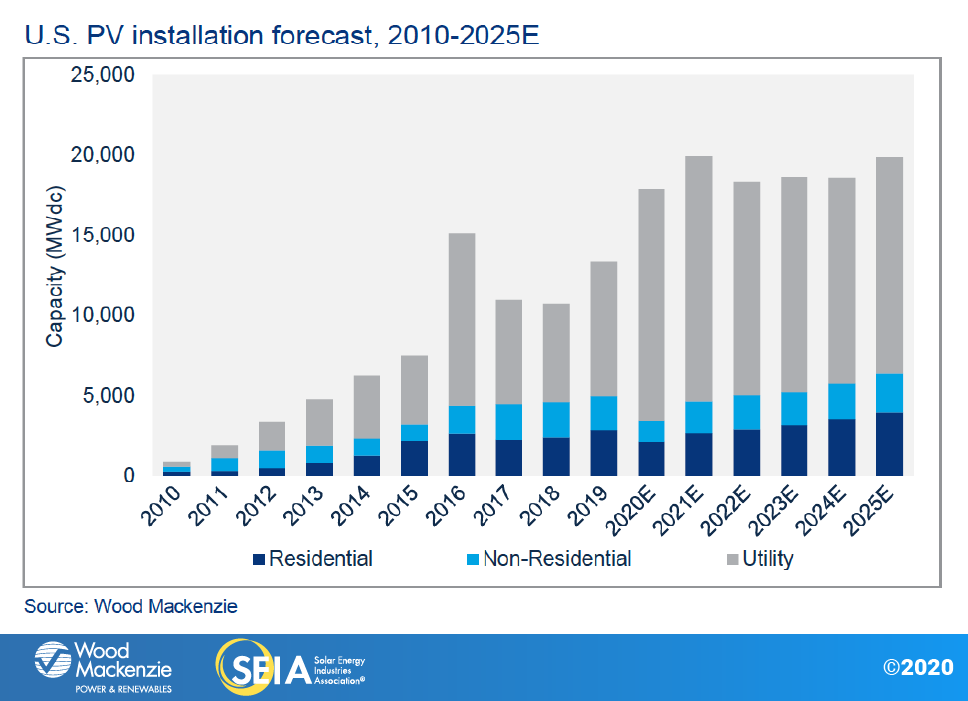

- Wood Mackenzie forecasts 33% annual growth in 2020, with nearly 18 GWdc of installations expected. Due to the coronavirus pandemic, we have made a 9% reduction (1.7 GW) to our previous 2020 market outlook, where we forecast nearly 20 GW of solar for the year.

- In total, the U.S. solar market will install 113 GWdc of solar from 2020-2025, a loss of 3.6 GW relative to our 2019 Year in Review report, an amount nearly equal to the cumulative total of PV installed through 2011.

- By 2025, one-third of new residential solar systems and one-quarter of new non-residential solar systems will be paired with energy storage.

2. Introduction

A note about the impacts of the coronavirus outbreak: Since our last report publication in March, the coronavirus outbreak has evolved into a global pandemic with more than 5 million cases reported across the globe and 1.7 million cases in the U.S. as of publication. The pandemic has disrupted every conceivable facet of life, with state-level shelter-in-place orders and the consequent contraction in economic activity expected to reduce gross domestic product for the remainder of 2020 and a significant potential for longer-term impacts well beyond this year.

The solar industry is not insulated from this crisis. From early-stage customer acquisition and project origination to commercial operation, every phase of the solar project cycle has been disrupted across all sectors. This is particularly and most immediately acute in the near term for distributed solar. But utility solar will also experience the impacts of the pandemic in the form of near-term project delays, as well as tighter financial markets and disadvantaged economics due to depressed oil, gas, and power prices in the medium to long term.

That said, the Q2 2020 U.S. Solar Market Insight covers installation volumes in Q1 2020 in addition to forward-looking trends. Given the timing of the Covid-19 outbreak in the U.S., only a handful of states had begun to implement shelter-in-place orders by the end of Q1, meaning that the impacts of coronavirus on Q1 2020 installations were marginal. However, the projections for the remainder of 2020 and beyond contained in this report reflect near-term impacts on project and customer origination, in addition to the longer-term implications of reduced economic and business activity for consumer and business purchasing and utility procurement decisions. Our market outlook is supported by Wood Mackenzie’s macroeconomic modeling that projects a 5% contraction in U.S. GDP in 2020, followed by 3% growth in 2021. This is still a rapidly changing situation with continued potential for significant disruption.

Q1 2020 recap: In Q1 2020, the U.S. solar market installed 3.62 gigawatts-direct current (GWdc) of solar photovoltaic (PV) capacity, a 42% increase year-over-year and the largest Q1 ever. Despite the coronavirus pandemic beginning to take shape at the tail end of March, residential solar saw its largest Q1 on record, tying with Q4 2019 as the largest quarter for residential solar. Total non-residential PV (which includes commercial, government, nonprofit and community solar) installations saw an 8% increase over Q1 2019 and a 29% decrease from Q4 2019. More than 2.3 GWdc of utility-scale PV capacity came online in Q1 2020 – another Q1 record for the sector. Across all market segments, solar PV accounted for 40% of all new electricity-generating capacity additions in Q1 2020, similar to the share of new capacity added in 2019.

Residential solar was off to a historically strong start before the coron

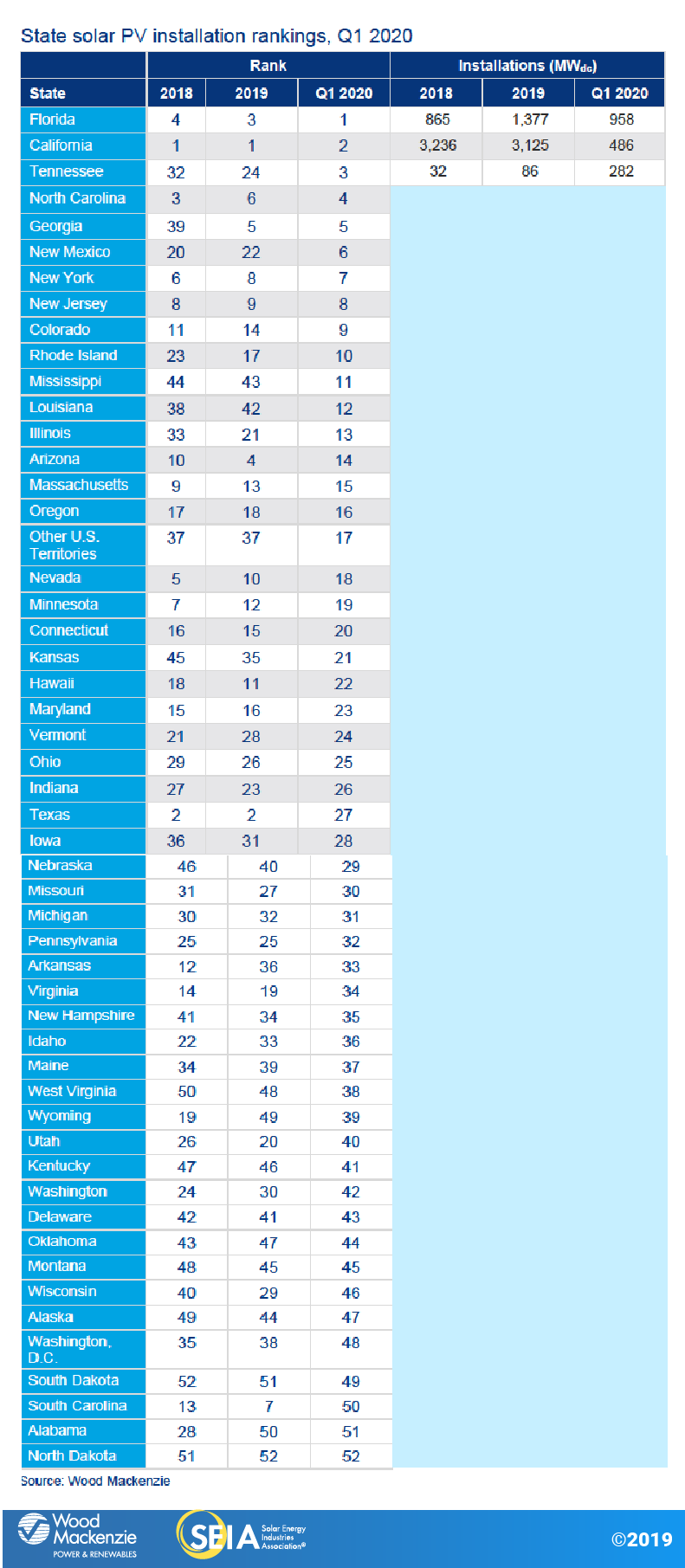

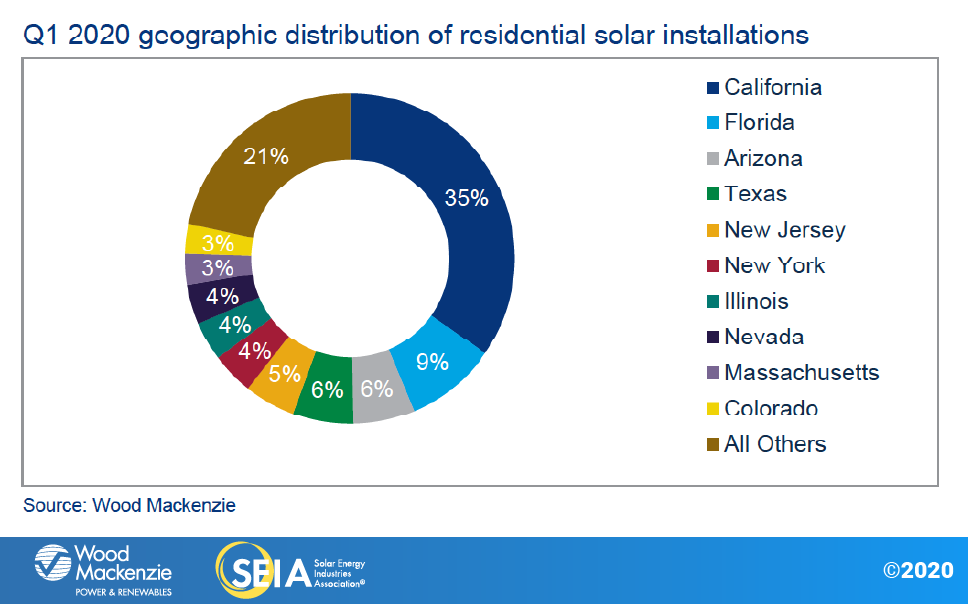

Thanks in large part to emerging state markets, residential solar was off to what would have been a record year for residential PV installations before the coronavirus pandemic hit the U.S. The states of Florida, Texas, Colorado, Illinois and Virginia all saw record-breaking installation totals in Q1 as a mixture of strong solar resources, declining installation costs and incentives pushed these states beyond retail parity. Meanwhile, established state markets in California, Arizona and the Northeast have maintained stable installation volumes. Because the coronavirus pandemic did not reach the United States until the end of Q1, the outbreak had a minimal impact on Q1 installation volumes.

However, we expect residential solar growth in Q2 to be severely hampered due to the pandemic, as many states implemented strict stay-at-home orders beginning in mid-March. At the outset of the pandemic, these orders were primarily concentrated on East and West Coasts, with the Northeast (and New York in particular) and California among the first states to issue shelter-in-place orders, while states with lower numbers of confirmed cases followed suit to varying degrees over the ensuing weeks.

At a basic level, shelter-in-place orders have significantly limited solar businesses from engaging in the face-to-face interaction that is a cornerstone of the residential customer-acquisition process. While many of the orders issued made exemptions for essential business services, they have not been uniform in their designations of what constitutes an essential business and whether solar construction and installation can continue. On the extreme end, solar construction has been halted completely by state authorities, such as in New York, which put a “PAUSE” on most construction work (including solar) from March 15-May 15, effectively wiping out half of the state’s expected Q2 installations. Other states such as New Jersey, Pennsylvania and Illinois have implemented specific restrictions on solar sales, with door-to-door canvassing specifically prohibited.

The first-order effect of this will be on Q2 2020 volumes, where major state markets with more stringent and longer-lasting stay-at-home orders will see a significant reduction in installations. Second-order effects beyond Q2 are expected to affect adoption throughout the remainder of 2020, as the impacts on economic growth become more wide-spread and further subdue consumer spending.

Non-residential showed signs of a turnaround in Q1, but the coronavirus pandemic has slowed new project development

The non-residential market came off of a robust Q4 2019 where many commercial project developers aimed to bring projects online in time to capture the solar Investment Tax Credit in the 2019 fiscal year, spurring an 8% increase on a year-over-year basis.

After several policy shifts hindered development in the core non-residential markets of California, Massachusetts and Minnesota in previous quarters, the market was off to a solid start in Q1. In Massachusetts, non-residential deployment figures began to increase as interconnection delays started to abate and the SMART program projects from the first phase of National Grid’s cluster study begin to come online. Meanwhile, New York’s long-awaited community solar renaissance has begun in earnest, with another 100 MW of community solar projects brought online in Q1 2020 following more than 160 MW being installed in Q4 2019.

That said, the coronavirus pandemic has been an impediment to both ongoing construction and to commercial project development – primarily with respect to early-stage development (permitting, zoning, etc.). Stay-at-home and construction stoppage orders initiated in March and April are delaying projects that would have begun construction in Q2. Additionally, large ground-mount projects must undergo a permitting process that typically involves public meetings in front of local zoning boards to receive construction approval. Many of these meetings have been postponed due to social distancing protocols, though some locales have transitioned to virtual platforms to conduct zoning meetings.

Because winter conditions restricted project construction in Q1, these delays to the permitting stage are expected to mostly impact projects that would have interconnected in Q2-Q3 2020.

Utility PV well positioned and remains strong despite risks from coronavirus

Despite the downside risks caused by the coronavirus pandemic including financial market instability, delayed procurement and reduced electricity demand, the continued high levels of procurement and demand for utility PV outweigh most of the current market headwinds.

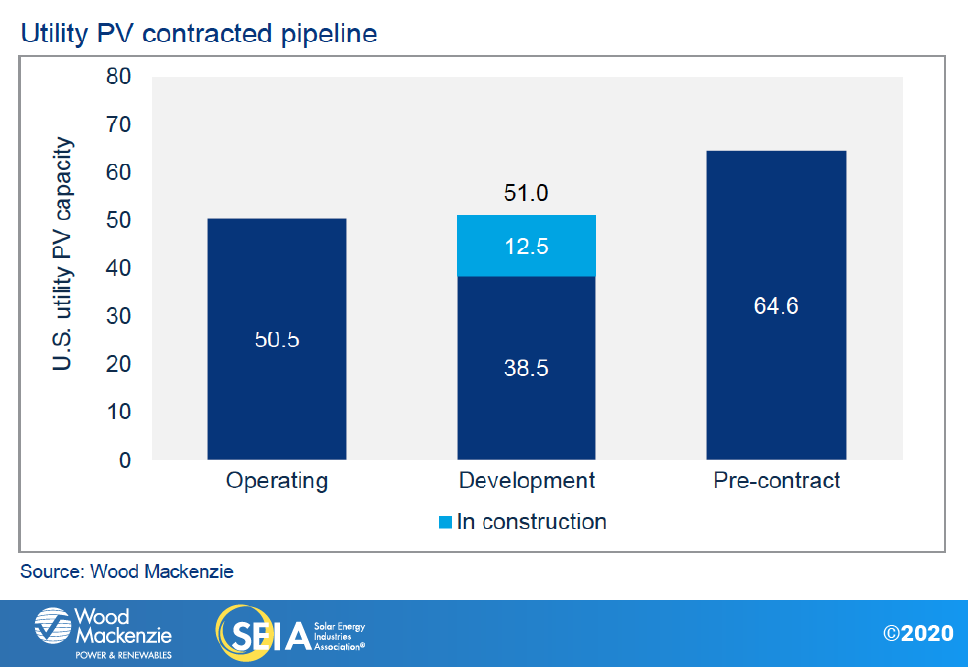

The 2020-2025 forecast has seen modest declines, but more than 80 GWdc of capacity additions are still expected over that timeframe. Utility PV project economics remain competitive with other sources of electricity generation. While impacts from the coronavirus pandemic will undoubtedly cause less utility PV to be built than would have been possible under normal circumstances, the 51 GWdc contracted pipeline signals that strong interest in utility-scale solar persists as of the time of publication.

Projects slated to come online in 2020 have seen minimal equipment and construction delays and are moving forward. Q1 saw 2.3 GWdc of new capacity added, and the utility solar market is still on track for 14.4 GWdc of new capacity in 2020. This would break the previous annual capacity addition record in 2016 of 10.7 GWdc and make 2020 the biggest year on record for utility PV.

In the medium and long term, utility PV faces several headwinds but is still expected to perform well. The economic instability caused by the coronavirus pandemic has increased the cost of capital, causing a potential increase in power-purchase agreement prices, which have ranged from $16 to $35/MWh in recent quarters. Despite these challenges, utility solar remains economically competitive with other generation sources, driving new procurement in established markets.

Overall demand for utility PV keeps growing as utilities announce more solar procurement targets in their integrated resource plans, backing aggressive state renewable targets. However, the Covid-19 crisis does present significant risks to the market. With financial markets in flux, it is unclear if there will be sufficient tax equity supply to provide ITC financing to all projects. Smaller projects face a higher likelihood of being passed over, and tax equity investors are likely to be more hesitant to work with new or less established developers. In addition to the tightness in the tax equity market, the cost of debt has also crept up a few basis points as debt providers have become wary of nontraditional investments. All these factors create considerable downside risk in the 2021-2025 forecast, and we will continue to closely monitor developments in the financial market

3. Market Segment Outlooks

3.1. Residential PV

Key figures

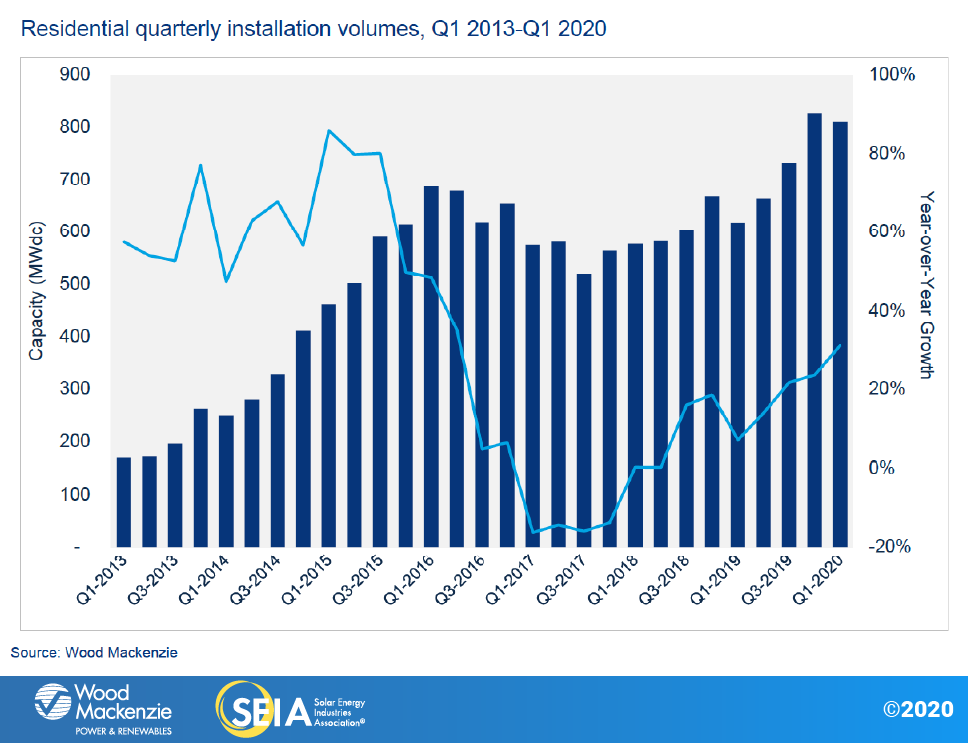

- 810 MWdc installed in Q1 2020

- Flat over Q4 2019

- Up 31% over Q1 2019

This year was expected to be a banner year for residential solar PV before the coronavirus pandemic hit. At 810 MW installed, last quarter was the largest in residential solar history. It was also effectively flat compared with Q4 2019, bucking the historical trend of seasonal cyclicity that underpins the residential solar narrative of depressed Q1 installation volumes stemming from winter weather. Moreover, the delta between Q1 and a record-breaking Q4 was expected to be even greater due to the rush of projects seeking to qualify for the full 30% solar Investment Tax Credit. However, major state markets such as California and New York began to implement stay-at-home orders in mid-March, which inhibited sales, installations and interconnections in the last few weeks of Q1. The timing of these orders likely stunted what was on track to be the largest quarter ever for residential solar.

California and the Northeast continue to be the foundation of the U.S. residential solar market, maintaining stable installation volumes on a quarter-over-quarter basis. But in Q1, these legacy state markets (CA, AZ, MA, NY, NJ, MD) accounted for just over half of total installations as a growing cast of emerging markets continue to scale and contribute to meaningful national-level solar growth. Florida, Texas, Colorado, Illinois and Virginia all had record installation totals in Q1, accounting for nearly a quarter of Q1 installations – also a record.

This growing geographic diversity is important for assessing the impacts of the coronavirus pandemic on residential installations. Throughout Q2 thus far, California and the Northeast have issued and maintained firmer stay-at-home guidance that has slowed sales and installation processes, which in turn will result in a more severe near-term installation decline for those states. Elsewhere, many of the emerging state markets that led Q1 solar growth have far fewer Covid-19 cases than do the East and West Coasts, and as of this writing they have begun to gradually loosen stay-at-home restrictions and open the economy to limited business activity. These states will accordingly see relatively smaller Q2 installation impacts due to the coronavirus outbreak but will still be impacted by the macroeconomic impacts of the crisis. Continued progress in those markets beyond Q2 is contingent on business activity remaining open.

Operationally, despite the rocky transition from largely in-person sales processes to a full-cycle virtual sales approach, the solar industry – and particularly large and midsized regional installers – have seen lead volumes and closed sales return to pre-Covid-19 levels, while smaller companies that rely heavily on word-of-mouth sales have had a harder time transitioning. While the near-term impacts from shelter-in-place orders will be felt most acutely in Q2, many large installers report healthy sales pipelines that they expect to fulfill into Q2 and Q3, assuming shelter-in-place orders are largely removed. However, it is difficult to say how these observations translate to overall market performance.

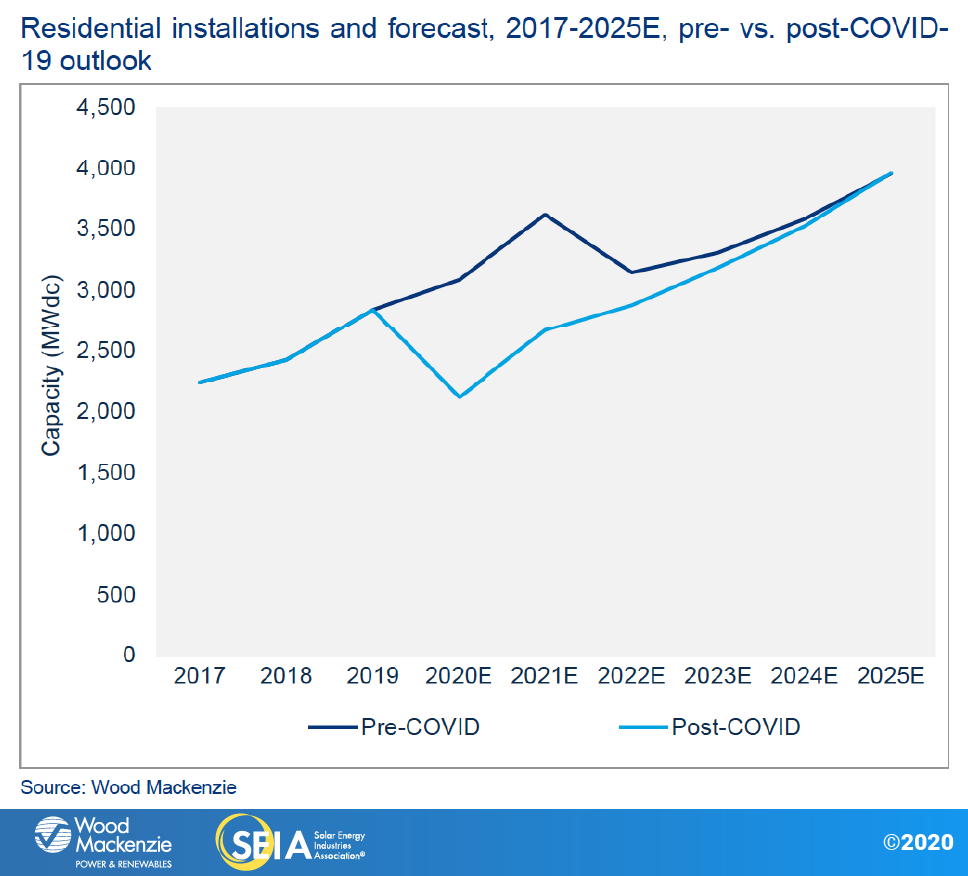

All that said, the longer-term implications of the coronavirus pandemic on the economy cannot be ignored. Wood Mackenzie forecasts a 5% contraction to U.S. GDP in 2020. This outlook reflects current guidance from the CDC and public health officials, which assumes that early reopening of the economy will result in a wave of secondary localized outbreaks that will cause additional statewide shutdowns and reduced economic activity. Though we have yet to see this reflected in the near-term sales pipeline, increasing – and unprecedented – unemployment levels among key demographics of residential solar customers, combined with the impact of GDP contraction on consumer spending, will result in a 25% decline in 2020 residential volumes compared to 2019 before a 26% annual increase in 2021 as the market begins to experience a tepid recovery. Our projections for both 2020 and 2021 are down significantly from our pre-Covid-19 forecast released last quarter.

Beyond the impact of the coronavirus pandemic in 2020-2021, the ITC stepdown in 2022 will further complicate recovery efforts, though modest growth will resume in 2023 and continue into 2025, based on economic fundamentals as the market adjusts to post-ITC market conditions. Long-term growth in a post-ITC world will be contingent on continued geographic diversification outside of established state markets as well as regulatory, technological and business-model innovation to improve product offerings in the solar-plus-storage space. Assuming modest growth on these fronts, residential solar’s annual growth is expected to reach low-teen percentages by the mid-2020s.

3.2. Non-residential PV

Key figures

- 499 MWdc installed in Q1 2020

- Down 29% from Q4 2019

- Up 8% from Q1 2019

Q1 saw a solid showing for the non-residential sector following its second-largest quarter ever. This is due in part to mild winter conditions, which allowed construction and interconnection to continue in some Northeast markets. Additionally, Q1 was bolstered by another quarter of strong community solar interconnections in New York, which helped the Empire State attain its second-largest quarter on record.

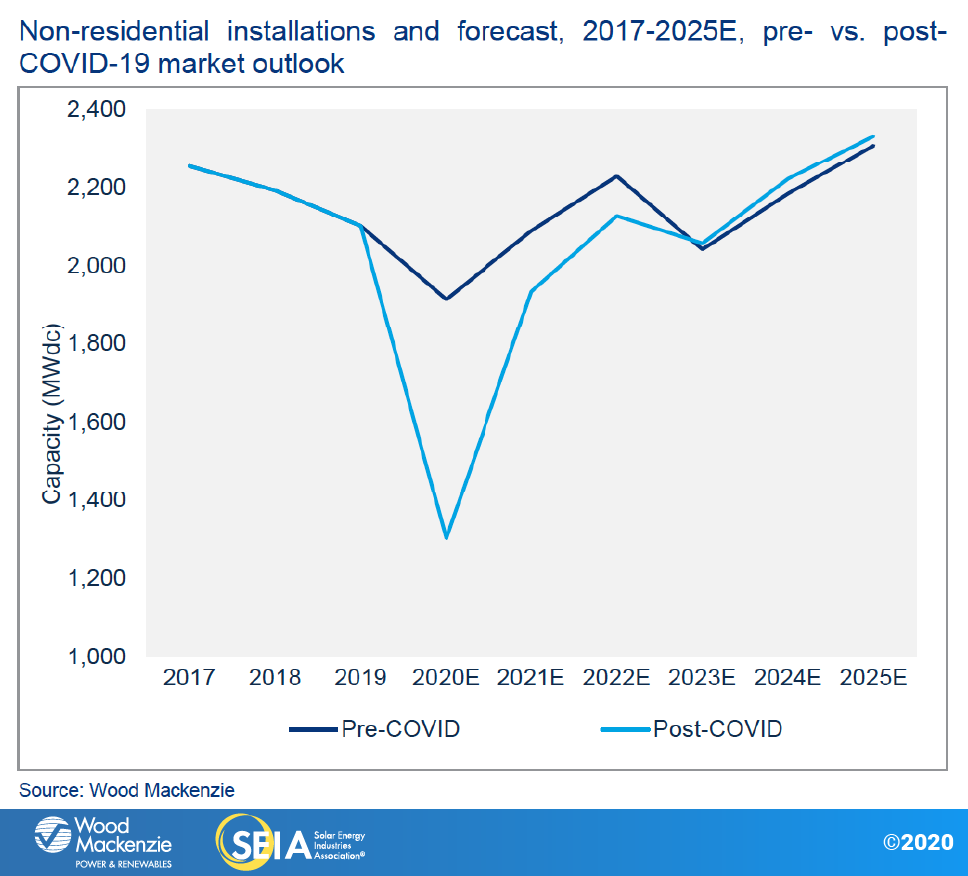

Coronavirus impacts on the non-residential market will be more evenly spread throughout the year than in the residential market; this is due to the longer development timelines of the former category of projects. Shovel-ready, permitted projects with signed contracts can begin or continue construction, unless local authorities have restricted developers from doing so – such as in the case of California and New York. But projects that have yet to receive permits from local zoning authorities are experiencing delays of three to six months, as most large ground-mount PV projects require public meetings to obtain approval to construct. While some locales have transitioned to online zoning meetings, there is no uniformity to the process across jurisdictions. Accordingly, the near-term impact of the coronavirus pandemic on non-residential solar will result in significant project delays – though not necessarily cancellations – in 2020, resulting in a 38% decline from 2019 volumes. Delayed projects will spill into 2021, leading to a 49% increase over 2020, but still well below both 2019 and pre-Covid-19 forecast levels.

While the near-term impact of the coronavirus outbreak on the non-residential space will result in project delays, the long-term impact of GDP contraction and a decline in business expenditures for capital investments are already beginning to affect new origination opportunities. Companies transitioning to the “new normal” are prioritizing core commercial operations while deferring decisions on energy investments until there is more certainty about the future of the economy and the business environment. Additionally, lower commercial activity has reduced C&I energy consumption, which will impact the installation footprint for businesses that choose to go ahead with solar. Accordingly, 2022 will grow only slightly over 2021 before the market experiences another contraction in response to the ITC expiration in 2023.

3.3. Utility PV

Key figures

- 2.3 GWdc installed in Q1 2020, the largest Q1 for utility PV in history

- Utility PV pipeline currently totals 51 GWdc

U.S. utility solar PV saw its strongest Q1 in history with 2.3 GWdc coming online while the pipeline of new projects has hit a new high of 51 GWdc. Fully 12.5 GWdc of utility PV projects are currently under construction, 76% of which are on track to be completed in 2020. This bolsters the confidence underpinning our forecast of 14.4 GWdc in 2020. While several companies have reported issuing force majeure notices in anticipation of possible project delays, developers, utilities and engineering, procurement and construction providers have reported relatively few delays from their supply chains, and projects that have received a formal notice to proceed are facing minimal additional delays due to the pandemic. To this point, the impacts of the coronavirus pandemic on the utility solar sector have been manageable.

However, the virus does pose risks to the medium- and long-term forecast. There have been a few reports that some request-for-proposal processes have been delayed by up to 14 days. While this might have only minimal effects on expected power delivery timelines, further RFP delays will lead to decreases in long-term forecasts. Additionally, there is a growing level of project finance risk. In the near term, developers have reported an increase in the cost of capital due to riskier market conditions. Should cost-of-capital increases ultimately lead to power-purchase agreement (PPA) price increases, demand for utility-scale solar will be impacted.

There is also growing concern around access to tax equity financing. With tax equity investors uncertain of their future tax liability and uncertainty drawing some tax equity investors away from the market, there is a risk that tax equity financing supply may not be able to meet demand in the coming months. It is likely that established, larger developers and large projects will have the easiest time finding tax equity financing, while smaller projects and less-established developers will have a harder time securing tax equity.

There is also substantial downside risk for reduced demand from commercial and industrial offtakers. While the majority of C&I offtakers have indicated that signed offtake agreements seem to be moving forward unhindered by the coronavirus pandemic, many companies are facing economic turmoil, which may decrease demand from C&I offtakers in the coming years. Established C&I customers with experience navigating PPAs have reported that their internal focus has shifted to critical operations and that they expect it will be harder to achieve internal buy-in from financial, legal and executive teams to sign off on new projects. The number of potential new C&I entrants is likely to decline due to pressure from corporate partners resulting in fewer new C&I offtakers signing first-time PPAs. Finally, the creditworthiness of C&I offtakers might become a more prominent issue. While creditworthiness has always been a concern, the uncertainly in the current market may make it harder or impossible for some corporate offtakers to find financing and get deals done.

Despite increased risks stemming from financial instability, supply-chain delays and risk of lower power demand caused by the coronavirus pandemic, our utility PV forecast has been mostly unchanged by the public health crisis. Factors including the steady flow of newly contracted projects, increasing price-competitiveness in many markets, the growing number of utilities outlining utility solar in their internal resource plans, and the continued push by many states for more ambitious renewable portfolio standards have all contributed to a strong long-term outlook for utility solar. Through Q1 2020, procurement has remained strong, with 4.9 GWdc of new projects announced, the majority of which are targeting 2021 and 2022 commercial operation dates. Accordingly, we have increased our 2021 and 2022 forecasts modestly to 15.2 and 13.3 GWdc, respectively.

All utility PV projects looking to qualify for the 22% or greater Investment Tax Credit will need to complete construction by the end of 2023. When the ITC was originally expected to step down from 30% to 10% in 2016, it caused capacity additions to surge from 4.3 GWdc in 2015 to 10.7 GWdc in 2016. With the gradual stepdown of the ITC from 30% in 2019 to 10% in 2022, plus the commence-construction provision that effectively extends the credit to 2023, demand pull-in has been more evenly dispersed across the period 2020-2023. This will cause 2023 to experience less of a spike in completed projects than was seen in 2016.

Despite the ITC phasedown to 10% in 2022, demand for utility PV will remain strong, averaging 13.3 GWdc per year from 2022 to 2025. Utilities such as the Tennessee Valley Authority, Dominion and DTE Energy continue to add increasing volumes of utility solar to their long-term resource plans. Additionally, many states continue to increase their renewable portfolio standard requirements, extend pledges to meet targets outlined by the Clean Power Plan, or increase renewables commitments through the signing of executive orders. The demand for utility PV will remain strong well into 2024 and throughout the decade, due not only to policy mandates for more clean energy but also to the declining costs of utility PV that make solar the most economically competitive resource in most state markets.

While projects slated to come online from 2021 to 2025 face a great deal of risk from coronavirus impacts, the strength of the current pipeline and additional demand from utilities for new electricity generation or to meet renewable portfolio standards and carbon reduction pledges will drive significant capacity additions through this period. While there is still uncertainty in the market, our current post-2020 forecast assumes continued stability in the financial markets and an economic recovery that keeps long-term electricity demand at current projections. If the economic impacts from the current pandemic intensify and linger long past 2020, it could result in reduced availability of financing and decreased demand for power that could in turn reduce or eliminate the need for new utility solar, bringing about a reduction in the U.S. utility PV forecast for 2021-2025.

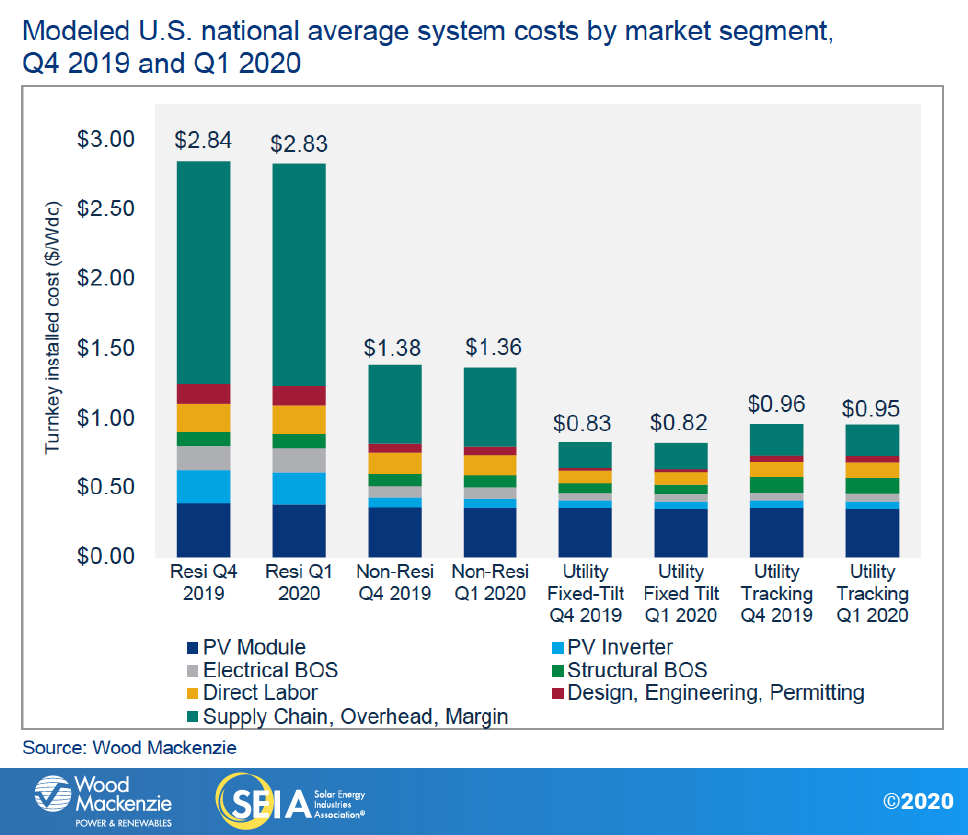

4. National Solar PV System Pricing

We employ a bottom-up modeling methodology to capture, track and report national average PV system pricing for the major market segments. Our bottom-up methodology is based on tracked wholesale pricing of major solar components and data collected from multiple interviews with industry stakeholders. Due to increased demand for mono PERC solar modules, beginning with the 2019 Year in Review report, we began to report blended module prices for the non-residential and utility market segments in addition to residential. This represents a weighted average of multicrystalline and mono PERC solar modules as opposed to pricing for multicrystalline modules only. Since the fourth quarter of 2019 is the first quarter in which these new blended system prices were applied, Q4 2019 system prices and those of previous quarters for the non-residential and utility sectors will not be commensurable. Mono PERC solar modules are more expensive than multicrystalline modules, so the new blended module price methodology will yield higher system prices.

Note: Module prices from Q4 2019 and onward reflect a blended module price across all market segments. Previous quarters only reflected multi-silicon module prices for the non-residential and utility segments. It is important to note this when making comparisons in system prices for periods prior to Q4 2019. Detailed information about national system prices by market segment and component is available in the full report.

In Q1 2020, system pricing fell across all market segments. System pricing fell quarter-over-quarter by 0.4%, 1.42%, 1.5% and 0.4% in the residential, non-residential, utility fixed-tilt and utility single-axis tracking markets, respectively. Prices across all market segments are now at $2.83/Wdc, $1.36/Wdc, $0.82/Wdc and $0.95/Wdc for residential, non-residential, utility fixed-tilt and utility single-axis tracking systems, respectively. Utility fixed-tilt pricing showed the steepest decline in quarter-over-quarter prices, compared to all other market segments.

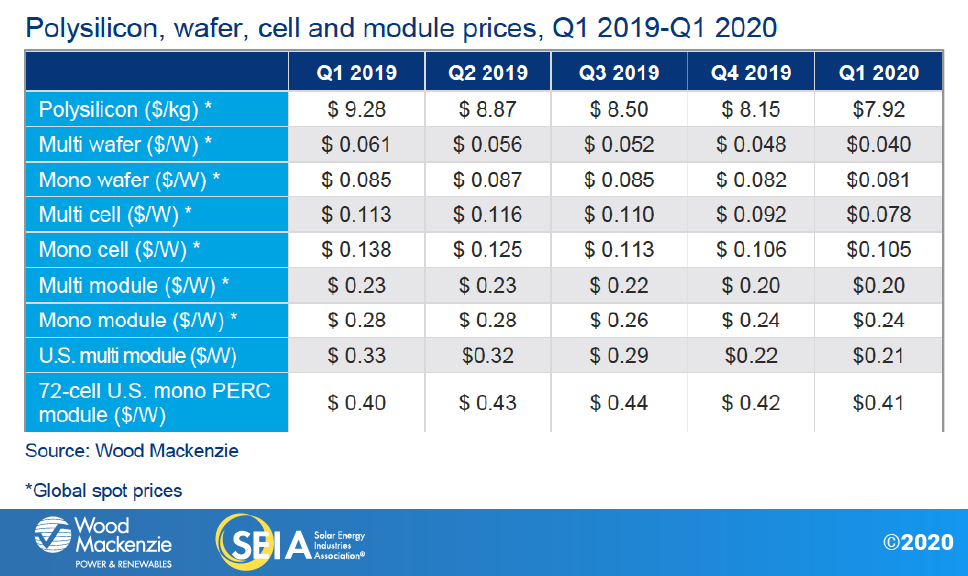

5. Component Pricing

The coronavirus pandemic affected the global PV supply chain in Q1 2020, causing a lower production level in China and Southeast Asia in January and February. The supply chain saw uneven pricing impacts as multi product prices continued to trend lower while mono product prices held steady. Polysilicon prices decreased by 3.5% in Q1. Multi wafer prices declined by 17% in the same quarter, significantly outpacing price declines for polysilicon and mono wafers, which saw only a 1% price drop in Q1. The driving force behind the divergence of multi and mono prices is the changing market preference that has rendered multi wafers less popular. As a result, multi cell and multi module global spot prices continued to fall for the third quarter in a row. Mono cell and mono module prices were essentially the same in Q1 2020 as in Q4 2019. The impact of the coronavirus pandemic on solar PV production and supply chains erased all the potential mono product price reductions.

In the U.S., multisilicon module prices were around $0.21/W in Q1 2020. The continued low price reflects the market’s preference for mono modules over multi modules. Mono PERC module prices dropped only slightly to $0.41/W for utility-scale projects.

In Q1 2020, bifacial modules enjoyed a tariff-free period while the U.S. Court of International Trade’s temporary injunction on re-imposing the Section 201 tariff was in effect. Without tariffs, the pricing of bifacial modules was, on average, competitive with mono-facial modules.

About the Report

U.S. solar market insight® is a quarterly publication of Wood Mackenzie and the Solar Energy Industries Association (SEIA)®. Each quarter, we collect granular data on the U.S. solar market from nearly 200 utilities, state agencies, installers and manufacturers. This data provides the backbone of this U.S. solar market insight® report, in which we identify and analyze trends in U.S. solar demand, manufacturing and pricing by state and market segment. We also use this analysis to look forward and forecast demand over the next five years. All forecasts are from Wood Mackenzie, Limited; SEIA does not predict future pricing, bid terms, costs, deployment or supply.

-

References, data, charts and analysis from this executive summary should be attributed to “Wood Mackenzie/SEIA U.S. solar market insight®.”

-

Media inquiries should be directed to Wood Mackenzie’s PR team (WoodmacPR@woodmac.com) and Morgan Lyons (mlyons@seia.org) at SEIA.

-

All figures are sourced from Wood Mackenzie. For more detail on methodology and sources, click here.

-

Wood Mackenzie Power and Renewables partners with Clean Power Research to acquire project-level datasets from participating utilities that utilize the PowerClerk product platform. For more information on Clean Power Research’s product offerings, visit https://www.cleanpower.com/

Our coverage in the U.S. Solar Market Insight reports includes all 50 states and Washington, D.C. However, the national totals reported also include Puerto Rico and other U.S. territories. Detailed data and forecasts for 50 states and Washington, D.C. are contained within the full version of this report. To find out more, click here.

Note on U.S. solar market insight report title: WM P&R and SEIA have changed the naming convention for the U.S. solar market insight report series. Starting with the report released in June 2016 onward, the report title will reference the quarter in which the report is released, as opposed to the most recent quarter in which installation figures are tracked. The exception will be our year in review publication, which covers the preceding year’s installation volumes despite being released during the first quarter of the current year.

About the Authors

Wood Mackenzie Power & Renewables | U.S. Research Team

Austin Perea, Senior Solar Analyst (lead author)

Colin Smith, Senior Solar Analyst

Michelle Davis, Senior Solar Analyst

Xiaojing Sun, Senior Solar Analyst

Bryan White, Solar Analyst

Molly Cox, Solar Analyst

Gregson Curtin, Research Asssociate

Solar Energy Industries Association | SEIA

Shawn Rumery, Director of Research

Aaron Holm, Data Engineer

Rachel Goldstein, Solar and Storage Analyst

Justin Baca, Vice President of Markets & Research

License

Ownership rights

This report (“Report”) and all Solar Market Insight® (“SMI”)TM reports are jointly owned by Wood Mackenzie and the Solar Energy Industries Association (SEIA)® (jointly, “Owners”) and are protected by United States copyright and trademark laws and international copyright/intellectual property laws under applicable treaties and/or conventions. Purchaser of Report or other person obtaining a copy legally (“User”) agrees not to export Report into a country that does not have copyright/intellectual property laws that will protect rights of Owners therein.

Grant of license rights

Owners hereby grant user a non-exclusive, non-refundable, non-transferable Enterprise License, which allows you to (i) distribute the report within your organization across multiple locations to its representatives, employees or agents who are authorized by the organization to view the report in support of the organization’s internal business purposes, and (ii) display the report within your organization’s privately hosted internal intranet in support of your organization’s internal business purposes. Your right to distribute the report under an Enterprise License allows distribution among multiple locations or facilities to Authorized Users within your organization.

Owners retain exclusive and sole ownership of this report. User agrees not to permit any unauthorized use, reproduction, distribution, publication or electronic transmission of any report or the information/forecasts therein without the express written permission of Owners.

Disclaimer of warranty and liability

Owners have used their best efforts in collecting and preparing each report.

Owners, their employees, affiliates, agents, and licensors do not warrant the accuracy, completeness, correctness, non-infringement, merchantability, or fitness for a particular purpose of any reports covered by this agreement. Owners, their employees, affiliates, agents, or licensors shall not be liable to user or any third party for losses or injury caused in whole or part by our negligence or contingencies beyond Owners’ control in compiling, preparing or disseminating any report or for any decision made or action taken by user or any third party in reliance on such information or for any consequential, special, indirect or similar damages, even if Owners were advised of the possibility of the same. User agrees that the liability of Owners, their employees, affiliates, agents and licensors, if any, arising out of any kind of legal claim (whether in contract, tort or otherwise) in connection with its goods/services under this agreement shall not exceed the amount you paid to Owners for use of the report in question.