Section 201 Solar Tariffs

In January 2018, The Trump Administration Placed Tariffs on Imported Solar Cells and Modules. Here’s What It Means.

On Jan. 23, 2018 President Trump signed a proclamation that placed tariffs on imported solar cells and modules for a period of four years. This decision came on the heels of a nearly 9-month case before the U.S. International Trade Commission (ITC) after two solar manufacturers, Suniva and SolarWorld, filed a petition seeking tariffs. The final tariff has had significant negative impacts on the entire solar industry, from manufacturing and distribution to installation and finance.

Quick Facts

- The effective date of the tariffs is February 7, 2018.

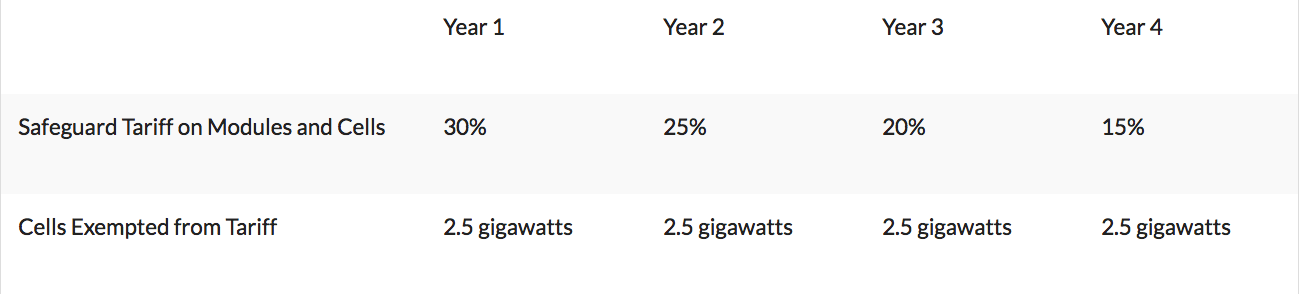

- The tariff level was set at 30%, with a 5% declining rate per year over the four year term of the tariff (see table below).

- The proclamation included a 2.5 gigawatt exemption for cells per year, which does not include any sub-quotas for individual countries.

- The only countries excluded from the tariff are those that the U.S. government deems “GSP-Eligible” developing nations. However, The Phillippines and Thailand are not excluded, even though they are GSP-Eligible.

Timeline and Review

Based on the Section 201 statute, tariffs are subject to a mid-term review. The ITC began the process of collecting information in Summer 2019, and will send its report to the President on February 7, 2020. SEIA is engaging closely with this process to demonstrate the impact of tariffs on the solar industry.

What this case means for the U.S. solar industry

The historic growth of solar energy in the U.S. has shown that increases in deployment depend on falling costs. Across all market segments, solar is competing with other low-cost fuel sources such as wind and natural gas. At such thin margins, even the slightest increase in the price of modules can mean that homeowners, utilities and businesses will choose an alternative for their power generation.

That’s why these tariffs are damaging to the entire U.S. industry. With hardware costs increased as a result of import fees, many projects will not pencil out. This translates to losses in jobs and economic investment, and a missed opportunity to grow the U.S. economy.

As for U.S. solar manufacturing, these tariffs have not significantly changed the landscape. Based on the timeline for getting a manufacturing facility financed, developed and certified, and due to the tariff being placed on cells as well as assembled modules, companies that had not already been planning to establish a U.S. manufacturing presence will be unlikely to benefit from these tariffs.

As a result, the U.S. will continue to import 80%-90% of our solar cells and modules at a higher cost due to the tariff, potentially putting solar out of reach for many homeowners, making some utility-scale projects uneconomical, and driving up prices for ratepayers.

The industry’s efforts

SEIA and our members have been working with government officials to demonstrate the effect these tariffs are having on the solar industry and the U.S. economy, including addressing shortages of solar cells and modules, particularly in the utility-scale sector. SEIA will continue educating the Trump administration on the drawbacks of tariffs during the mid-term review, while we maintain solar’s role as a dominant source of new energy development.

Our strategic efforts will be focused on:

- Ensuring that existing markets remain open and robust, while opening new ones.

- Continuing to defend federal and state tax incentives for solar.

- Reforming electricity markets to enable solar use at the highest values.

- Adapting and thriving as new technologies, such as energy storage, enter the landscape.