American Solar & Storage Manufacturing Renaissance: Managing the Transition Away from China

Key Takeaways

- The United States is undergoing a transformational buildout of domestic solar and storage manufacturing.

- Like other industries, the U.S. can and is breaking free from an overreliance on imports while building a resilient and equitable U.S. solar and storage manufacturing base.

- Manufacturing has the largest jobs multiplier of any segment of our economy. Every factory job creates employment opportunities in other sectors, such as sales and purchasing, marketing, accounting, human resources, warehousing and logistics, and raw material supply.

- We estimate that by 2030 the IRA will grow the solar and storage manufacturing workforce to 115,000 Americans and lead to more than 507,000 jobs across the entire industry.

- In the near-term, U.S. solar module factories must necessarily rely on imported cells while new cell factories are constructed. Similarly, cell factories will need to import wafers while domestic ingot and wafer factories are built.

- In the medium and long term, current policy provides a path to produce most solar and storage products domestically.

- It’s no secret that China dominates many components of solar and storage supply chains.

- It’s not enough to reduce our reliance, for example, on solar cell or module imports, we must also be able to produce solar and storage manufacturing equipment here in the United States or source this equipment from allied countries.

- This does not mean that we completely abandon global markets and supply chains, but rather that we reduce our reliance on China for solar and storage manufacturing equipment and raw materials.

- SEIA’s vision and goal is that by end of this decade, the United States will be the most competitive and collaborative solar and energy storage industry in the world, one fueled by American workers and our allies.

- The fact that the fuel source for solar – the sun, is free, plays in important role in the promise of abundant American energy.

Introduction

In 2022, the Solar Energy Industries Association (SEIA) predicted that U.S. solar manufacturing was poised for a boom if proposed energy tax incentives were signed into law. Today, that boom is underway as a direct result of the Inflation Reduction Act (IRA).

Already, there have been billions of dollars of IRA-related announcements for new domestic solar and storage manufacturing capacity, with many billions more on the way. What these companies realize is that we hold in our hands one of the greatest economic opportunities in generations and the ability to create many hundreds of thousands of durable, American careers in manufacturing, installation and construction, maintenance, engineering, logistics, finance and more

Figure 1: The U.S. Solar Manufacturing Supply Chain, including operational facilities and projects in various stages of development. Explore SEIA’s full Supply Chain Dashboard here.

The IRA also puts SEIA’s goal within reach for solar, alongside energy storage, to represent 30% of total U.S. electricity generation by 2030, a target that exceeds even President Biden’s ambitious plan for a carbon-free electric grid by 2035.

While this is all great news, the real work has just begun. It will take perseverance and a strategic mindset to break free from our overreliance on imports while building a resilient and equitable U.S. solar and storage manufacturing base. Managing this transition will be one of our greatest challenges.

It’s no secret that while change is on the way, China is currently the predominant player in many portions of the solar and storage supply chains. And as we’ve seen from recent Chinese government proposals to restrict the export of solar ingot and wafer technology, China has no intention of ceding its current competitive advantage. China also presents severe forced labor risks that the U.S. solar industry has been distancing itself from for over two years.

The United States must therefore strive to build a solar and storage manufacturing base that can stand on its own. It’s not enough to reduce our reliance, for example, on solar cell or module imports, we must also be able to produce solar and storage manufacturing equipment here in the United States and/or source this equipment from allied countries. Otherwise, we risk merely transferring reliance on imports from one segment of the industry to another. Technological leadership will also be closely aligned with the ability to produce the manufacturing equipment of the future.

Building a self-sustaining industrial base does not mean that we will no longer utilize ethical global supply chains, but rather that we rebalance our dangerous overreliance on China for equipment and raw materials. This is an important distinction we must recognize to achieve our U.S. solar and storage manufacturing goals and create a truly resilient U.S. manufacturing base. It will take a collaborative effort to reach our goals.

The American Solar & Storage Manufacturing Jobs Opportunity

In the past, we often heard the narrative that the United States doesn’t need manufacturing jobs and that manufacturing doesn’t create many jobs anyway. U.S. technology companies have often been cited to support the notion that the United States should focus on design and engineering jobs while relying on other countries to build products. It is a mistake, however, to overlook and undervalue the massive economic opportunity domestic solar and storage manufacturing provides.

Importantly, manufacturing has the largest jobs multiplier of any segment of our economy. What this means is that every factory job creates a multitude of employment opportunities in other sectors, for example, sales and purchasing, marketing, accounting, human resources, warehousing and logistics, and raw material supply. Indeed, a single factory can sustain an entire community. We estimate that by 2030 the IRA will grow the solar and storage manufacturing workforce to 115,000 Americans and lead to more than 507,000 jobs across the entire industry. And all these jobs will invariably lead to jobs in other sectors, hundreds of thousands more. Put simply, domestic manufacturing is a virtuous economic cycle.

Strategically Reducing Our Reliance on Imports

The United States currently has capacity to produce metallurgical grade silicon, polysilicon, steel, aluminum, resins, racking and mountings and other key materials. But significant gaps in the U.S. solar supply chain remain. For example, though many commitments are on the way, the United States has no substantial capacity to produce solar ingots, wafers, or cells and modest capacity to produce solar modules, inverters and trackers. There are also limited U.S. resources for solar specialty glass; with only three glass manufacturers identified in the United States. It is important to not only fill these gaps but also help expand and improve the competitiveness of existing U.S. manufacturing capacity. For example, new investments in existing polysilicon capacity are necessary to bring mothballed facilities online and improve the competitiveness of U.S. polysilicon production.

In the near-term, we will still require imports to fuel the rapid deployment of solar energy systems needed for the energy transition and to ensure abundant and affordable energy supply to keep our economy running. Even those companies that began planning domestic factories in anticipation of passage of the IRA still have 6-24 months before their facilities begin shipping products at commercial volumes. Other factories could take 3 years or more to bring online.

Southeast Asia currently represents the largest source of solar cell and module supply to the United States. These factories are run by Tier 1 manufacturers and have demonstrated the quality, financial stability and compliance necessary to underwrite warrantees for their products demanded by U.S. consumers. While this is better than having China as the primary source of U.S. cell and module supply, overreliance on even a handful of countries still presents risks, as witnessed by the supply chain challenges companies producing in Southeast Asia have faced over the past few years. The best solution to limiting these risks and building more resilient supply chains is to significantly expand domestic manufacturing.

Figure 2: PV Module Imports by Customs Value and Country of Origin

Reshoring Manufacturing

As noted above, the IRA has already led to a flurry of announcements for new manufacturing capacity including 47 GW of new modules, over 16 GW of cells, more than 16 GW of ingots and wafers, nearly 9 GWac of inverters and well over 100 GWh of battery manufacturing which also serves the electric vehicle industry. We are also seeing more than 20,000 tons of annual domestic polysilicon capacity coming back online and a multitude of new investments in tracker and racking capacity. We expect all of these sectors to grow exponentially.

Figure 3: Existing and announced solar and storage manufacturing capacity (for facilities with public capacity figures)

New, expanded and restarted factories will help build the robust supply chain needed to power the Solar+ Decade and will help us secure energy independence. Moreover, we believe that the investments represented above are just the beginning. In the coming months, we expect several more announcements of new large-scale U.S. manufacturing, coming online in the next few years. Indeed, solar tracker manufacturers are leading the way with several new factories under construction and more to be announced later this year. And these factories will be driven by American workers utilizing American steel, a perfect example of manufacturing’s multiplier effect.

Factory Development, Construction and Commissioning Timelines

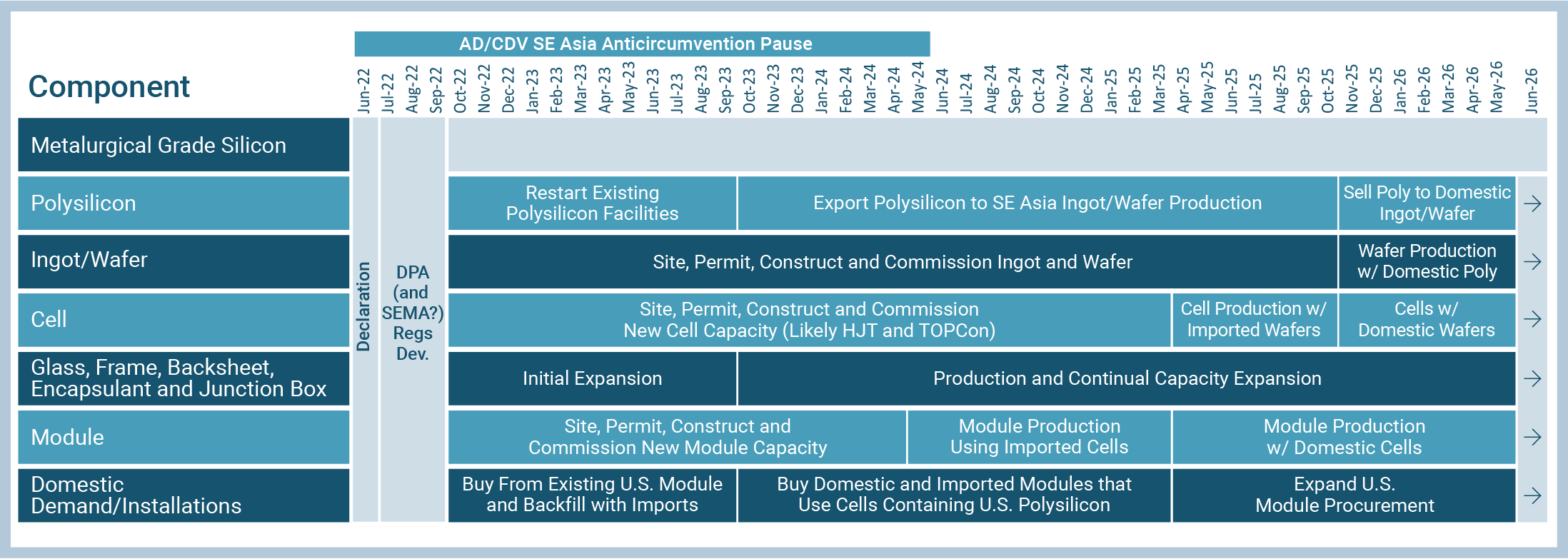

It is important to fill gaps across the entire domestic supply chain, going well beyond just finished products. In the near-term, U.S. module factories will continue to rely on imported cells while new cell factories are constructed. Similarly, cell factories will need to import wafers while domestic ingot and wafer factories are built. In addition, inverter producers will have to import chips, capacitors and transformers before factories supported by the CHIPS act are commissioned. Allowing necessary and ethical imports to continue during this transition period will be essential.

Figure 4: Gantt Chart of Solar Production Facility Timelines

In the medium and long term, current policy provides a path to produce most solar and storage products domestically but likely not all. And for any manufacturer to succeed, they require reliable access to components, materials and consumables to keep their own factory running. Reliability comes from optionality, having backup sources and suppliers. This is especially true when domestic supply falls short of demand. The disruption at any single upstream factory could negatively impact downstream factories unless those downstream factories can fall back on alternative sources of supply to keep things running during the transition period.

Principals of a Resilient Supply Chain

Proximity

Bringing manufacturing to the United States reduces many risks associated with dependance on imports. The last three years have shown how incidents like factory shutdowns in specific regions, shipping container shortages, port delays and more can wreak havoc on supply chains. Sourcing product from domestic suppliers not only mitigates those risks but also makes it easier for domestic buyers to tour factories and gain clearer lines of sight into their supply chains. Domestic manufacturing also brings greater economic benefits back to the United States.

Geographic Diversity

While bringing supply chains home is critical, it’s clear that supply concentration in any single geographic region carries risk. The high concentration of polysilicon production in China exposed the global solar supply chain to price spikes when electricity prices rose precipitously. Domestic supply chains should therefore be spread across the United States to reduce exposure to similar regional disruptions. And we must maintain access to imports that augment and backup domestic supplies of all key materials, lest a shortage of a key product disrupts the entire supply chain.

Scale

U.S. manufacturers must be able to offer in-demand products, sell at a competitive price and deliver consistently high-quality goods in sufficient quantities on time. For example, several overseas manufacturers individually have larger manufacturing capacities than the entire U.S. industry. This enables overseas suppliers to operate with economies of scale far beyond most U.S. facilities.

Manufacturing at scale is particularly important in the utility-scale segment where project developers require large volumes of products to be delivered over a relatively short period. Manufacturers also seek to avoid customer concentration risk, i.e., committing too high a percentage of a factory’s output to a single order. As a general rule, a solar module manufacturer’s capacity needs to be at least four times the size of a given project.

Reaching scale, however, takes large upfront investments and the ability to sustain higher production costs for an extended period of time. For these reasons, companies are reluctant to invest in U.S. manufacturing in the absence of long-term federal incentives. In recognition of this challenge, the IRA includes the Solar Energy Manufacturing for America Act (SEMA), a long-term tax incentive for certain domestically produced components, serving as a critically important driver of U.S. solar manufacturing.

Tax credits help both incentivize private sector investments in U.S. manufacturing capacity and close the cost gap between domestic production and imports. The vast majority of manufacturers currently considering U.S. factories have made clear that they would only move forward with large U.S. manufacturing investments if tax credits were enacted, and, for some, only if there was a productive way to monetize those credits, such as through direct pay. Both of these requirements were satisfied in the IRA.

Demand

Before committing to new U.S. manufacturing investments, companies need reasonable assurances that there will be sufficient demand for their products. Initially, new factories built in the United States will primarily serve domestic markets with exports as a secondary consideration. But we will become a solar and storage export powerhouse over time. Succeeding domestically is generally a precursor to competing globally.

Manufacturers must first consider the timing of demand for their products. For example, module, inverter, mounting system and tracker manufacturers can expect to see immediate demand for their products. In contrast, it will take time to build demand for other segments, such as ingots and wafers. It would therefore be suboptimal to complete a U.S. ingot/wafer factory before there is sufficient demand from domestic cell factories, as it is unlikely to be economical to export wafers while awaiting domestic demand. It will therefore be essential to match manufacturing investments with demand growth.

To assess demand, companies will look to U.S. installation forecasts and try to match anticipated demand with a prospective factory becoming operational. They will also look beyond that operational date to fully amortize the capital cost to build the factory. For example, if a factory today takes four years to become operational from the date of initial planning and an additional five years to operate at a high utilization rate and amortize costs, the manufacturer will seek assurances that U.S. demand for their products will be strong from mid-2026 through mid-2031.

Fortunately, the IRA includes a long-term extension of the solar Investment Tax Credit which will serve as a strong demand driver. Below is a forecast of U.S. solar and storage demand based on adoption of the IRA. This forecast demonstrates that a long-term extension of the ITC is a foundational demand driver and critical precursor to a renaissance in domestic solar manufacturing.

Figure 5: Comparison of Domestic & Imported Solar Module Supply with U.S. Installation Demand

The Importance of Workforce Development

A U.S. solar manufacturing industry is dependent upon a well-trained workforce. Manufacturing not only brings opportunities for permanent and high wage jobs, but also the ability to help offset job losses in traditional energy and manufacturing communities. To meet this need, the industry must work as hard to develop the American solar workforce as it does on building new factories.

U.S. solar manufacturing will require a readily available pool of production workers as well as solar-ready computer scientists, chemical engineers, electrical engineers, process engineers and more. A successful American solar workforce also depends upon collaboration between companies, government agencies and higher education institutions; to advance solar-specific technical training and college-to-career programs. For example, apprenticeship programs that provide professional development opportunities demonstrate that good manufacturing jobs are possible without a college degree. And while cross-sector partnerships will deliver results, government support will make a critical difference. Industry and the labor community must also commit to long-term partnerships and collaborative opportunities.

Building an Equitable U.S. Solar and Storage Manufacturing Base

And yet, it’s not enough to build a robust solar and storage manufacturing base in America. We must also commit to building a more inclusive and just energy economy. For example, utilizing existing tools, such as supplier diversity databases, can ensure that the solar industry draws from a wide talent pool and engages all communities in the benefits of solar. The industry should develop and advance scholarship, curriculum and internship programs with Black-, Latino- and Indigenous-serving institutions; as well as other organizations focused on diversity, equity, inclusion and justice (DEIJ) to create a talent pipeline of solar-ready graduates that truly represent America. Similar programs already exist within the solar installation segment and must be expanded to include manufacturing.

The industry should also seek partnerships with unions and community groups to ensure equitable access to apprenticeships and other quality, skill-building programs. In addition, workforce development should address the gender imbalance in the solar industry, particularly manufacturing and engineering roles which have traditionally been dominated by men.

Environmental justice is another critical consideration. The industry must minimize negative externalities in communities where manufacturing facilities are located and ensure that members of those communities are engaged and have a say in the siting and development of those facilities. Further, environmental responsibility should be incorporated into all aspects of the product lifecycle, from raw materials to end of life, with goals measured annually through environmental, health, and safety reporting. Advancing carbon reduction strategies, pursuing technological diversity and reducing the use of critical minerals in the solar supply chain are also important objectives.

Incorporating DEIJ principles into the solar manufacturing base not only benefits individuals and communities, but also garners meaningful support from external stakeholders. Acting now will help move the country towards a diverse and equitable solar industry which lives up to its full potential.

Conclusion

The IRA presents a once in a generation opportunity to build a globally competitive, self-sustaining domestic solar and storage manufacturing base that primarily relies on American workers and American ingenuity. Over the past few years, we’ve learned that overreliance on imports for our nation’s needs is dangerous and short-sighted. To be truly energy independent, the United States must be self-sufficient across all energy sectors, including fossil fuels, nuclear and renewables. While we certainly have work to do building a robust domestic solar and storage manufacturing base, the IRA has provided the necessary tools.

We can no longer rely on China for energy equipment needs. The risks are just too great. We should, however, be open to utilizing ethical global supply chains to source products that will help the United States grow. Still, SEIA’s vision and goal is that by end of this decade, the United States will be the most competitive and collaborative solar and energy storage industry in the world, one fueled by American workers and our allies