The 25D Solar Tax Credit: What Homeowners Need to Know

Date Updated: March 23, 2023

What Homeowners Need to Know About the Federal Solar Tax Credit for Residential Solar Energy Systems

There are two federal tax credits that incentivize solar installations: (1) the Section 48 Investment Tax Credit (ITC) available to businesses who invest in solar energy systems; and (2) the Section 25D residential credit that may only be claimed by individuals who purchase a solar energy system or a standalone energy storage system for their home.

These two federal solar tax credits have some important distinctions. For instance, you may have heard about additional credits above 30%, or the ability to sell the credits. Those features only apply to business-owned systems in certain circumstances, and are not available for systems purchased by individuals for residential use. SEIA put together this summary to help residential customers understand the basics of Section 25D tax credits.

Please note that this document is written for background purposes only and should not be considered tax or legal advice. For a more detailed application of these laws to your specific situation, please consult a tax professional.

Credit Amount

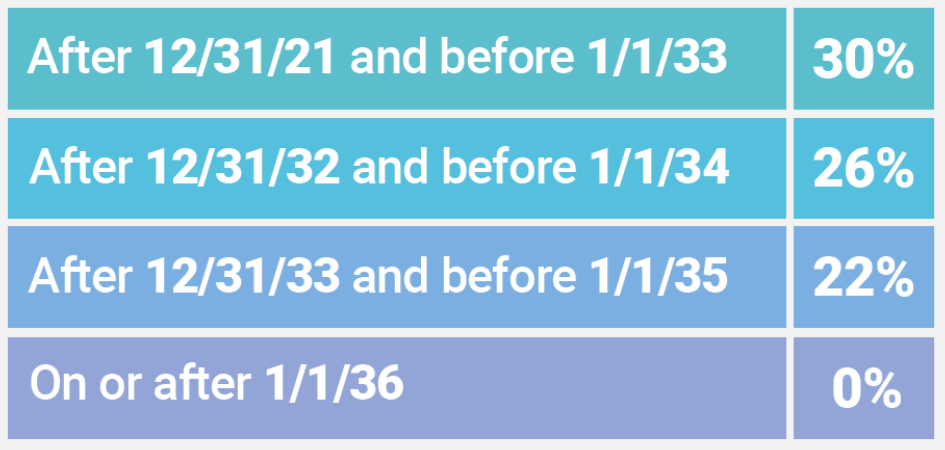

There is no dollar limit on the credit claimed. The exact rate of the credit depends on the date that the system is placed in service. The schedule is outlined in the image below.

Qualifying Solar Electric Property & Costs

- Qualified solar electric property includes costs for property that uses solar energy to generate electricity, such as inverters, batteries, and solar panels.

- In general, traditional roofing materials and structural components do not qualify for the credit.

- Solar roofing tiles and shingles that function as both traditional roofing and solar electric collectors as well as functions of both solar electric generation and structural support can qualify.

Battery Storage

Standalone energy storage systems (i.e. batteries without solar) are also eligible for the credits, but they must have a capacity of at least 3 kilowatt-hours.

Loans, Leases and PPAs

- You may borrow money to purchase your system, through a bank, home equity line of credit, or solar loan provider. In these cases, you are still eligible for the 25D tax credit.

- You might decide to sign up for a lease or Power Purchase Agreement (PPA) instead of purchasing the system outright. In these cases, you are not eligible for the 25D tax credit because you do not own the system. Rather, your installer would be eligible for the Section 48 business tax credit and would pass the value of the credit, or a portion of it, on to you through the lease or PPA price.

Eligible Homes

- The system must be installed in a residence used by you. The residence does not necessarily need to be your primary one.

- Eligible residences include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured home that conforms to Federal Manufactured Home Construction and Safety Standards.

Joint Occupancy

If you jointly own the residence with someone other than your spouse, then you must divide the credit with the co-owner.

Business Use

You can still claim credits if you use your residence for some business purposes. The amount depends on how much business is conducted in your home:

- If more than 80% is for non-business use, then you get the full credit.

- If less than 80% is for non-business use, then you get a reduced credit based on the allocation ratio.

Years to Claim the Credit

- For systems installed on existing homes, the credit is available in the tax year when the system is installed.

- For systems installed on new homes, the credit is available in the tax year when the home is put into use.

- It is not enough to have signed a contract, or to have made a down payment or even to have begun construction on the system. The system must be placed in service in order to claim the credit in that calendar year.

Unused Credits

Credits can only reduce your taxes and are not refundable. But any unused credits can be used in later years.

Claiming the Credit

To claim the residential credit, use Form 5695 to claim the residential tax credit when you file your taxes. For more information, visit the IRS’ Form 5695 Instructions Resource.

Helpful Links

For more information on navigating the process of the going solar check out these useful resources: